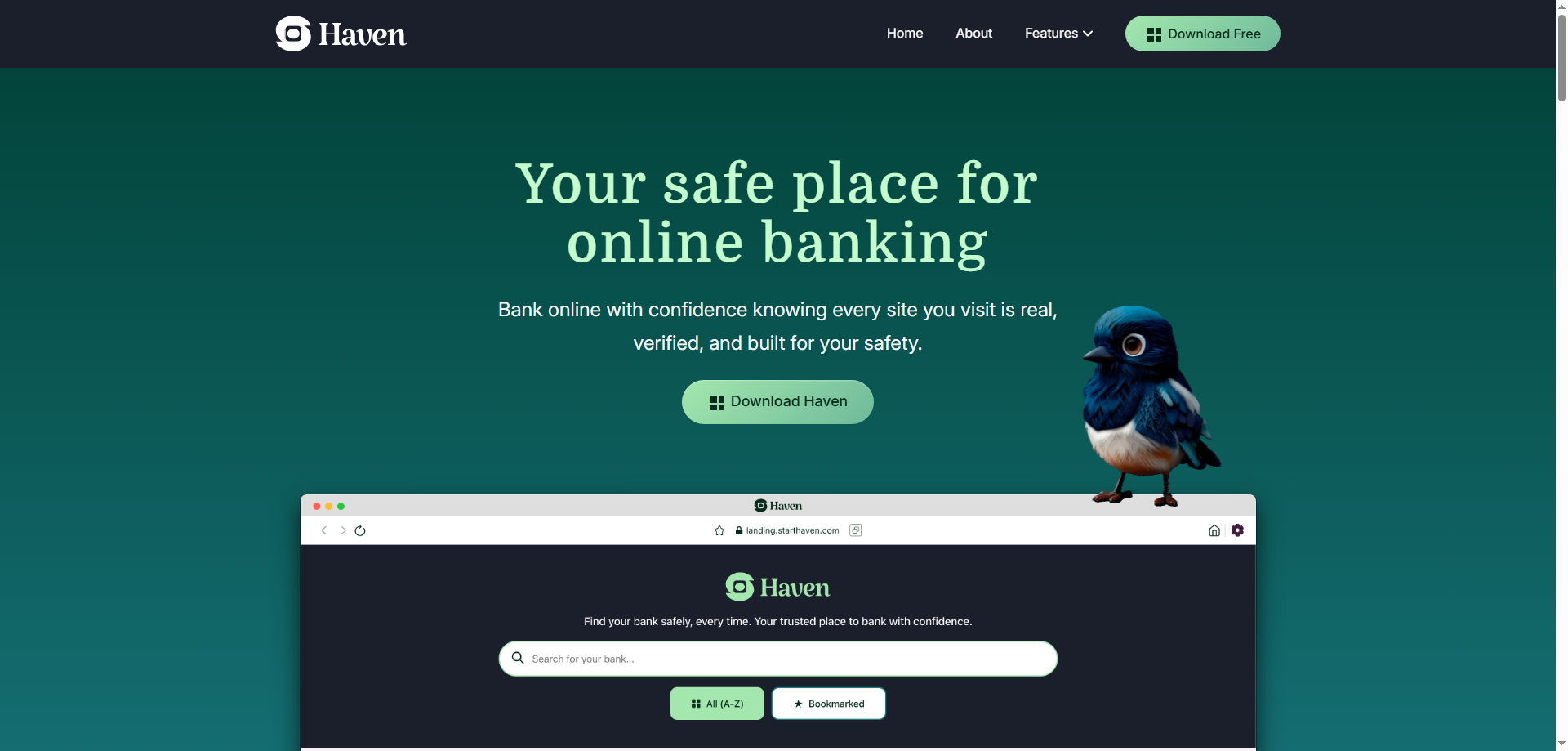

1. Creative Take on Haven: A Smarter Way to Bank Online

In today's digital world, online banking is a convenient way to manage finances, but it also comes with its share of risks. Phishing attacks, fraudulent websites, and hidden malware extensions are just a few of the threats that can put your financial information in danger. That's where Haven steps in—a clever, security-focused browser extension designed to make online banking safer and more reliable. Think of Haven as your personal bodyguard for banking, quietly protecting you as you navigate the web and manage your finances.

What makes Haven stand out is its context-aware approach to banking security. Instead of just offering a generic security measure, it focuses on preventing the specific threats you face when dealing with online banking, like fake bank websites or phishing attempts. Haven uses innovative tools like Pre-Flight Checks and Verified Search to ensure you're always on a legitimate, secure banking site before you even enter your credentials.

With Haven, you no longer have to worry about accidentally landing on a phishing page or following a malicious link. It automatically scans URLs, blocks suspicious activity, and alerts you to potential threats. This creates a calmer, more secure online banking experience, allowing you to manage your finances with confidence.

Key Features:

- Block Fake Bank Links: Prevents you from clicking on fraudulent links that could lead to malicious websites designed to steal your personal information.

- Phishing Protection: Identifies and blocks fake login pages that attempt to trick you into providing sensitive financial data.

- Detects Harmful Extensions: Alerts you to browser extensions that could be trying to snoop on your online activities or redirect you to scam sites.

- Pre-Flight Checks: Scans websites for security before you log in, confirming that you're on the legitimate bank website.

- Verified Search: Ensures that the search results leading to banking websites are from trusted, verified sources.

2. Disrupting Online Banking Security: Can Haven Replace Traditional Security Tools?

Online banking security is a crucial aspect of personal finance, and for years, we've relied on traditional tools like antivirus software and multi-factor authentication (MFA) to protect us. While these tools are helpful, they don’t specifically target the unique vulnerabilities associated with online banking. For instance, an antivirus might not block phishing links that are cleverly disguised as legitimate emails from your bank, or it might not protect you from landing on a counterfeit bank website through a search engine.

This is where Haven disrupts the traditional security approach. Instead of focusing solely on your device’s general security or just offering multi-factor authentication, Haven specifically addresses the critical vulnerability of fraudulent bank websites. It is a purpose-built solution for online banking security, ensuring you are always on the right site, free from phishing attempts and fake links.

Haven’s unique features like Pre-Flight Checks and Verified Search offer more targeted protection than traditional tools. Pre-Flight Checks run a quick security scan of the banking website before you even log in, confirming its legitimacy. Meanwhile, Verified Search ensures that the search results you click on are verified and lead to your bank’s actual website, not a malicious copycat.

The bottom line is that Haven doesn’t just act as an additional layer of security—it redefines how we approach online banking protection. By addressing specific threats like phishing and fake websites, Haven can easily replace or complement traditional security tools that aren’t fine-tuned for the nuances of banking.

3. Meeting Real Needs: How Will Users Respond to Haven?

Given the increasing number of data breaches, phishing attacks, and online scams, users are more concerned than ever about protecting their financial information. Haven directly addresses these concerns by offering easy-to-use, proactive protection that targets the very real risks of online banking.

Here’s how different groups of users will likely benefit from Haven:

- Banking Users: Whether you’re doing your everyday banking, paying bills, or transferring money, Haven ensures that the website you're logging into is legitimate. For anyone who’s ever worried about accidentally entering their bank details on a fraudulent site, Haven offers peace of mind.

- Online Shoppers: Many people use their bank accounts for online shopping. Haven’s ability to block fake links and phishing attempts extends beyond just banking sites, providing broader protection when entering financial details on e-commerce websites.

- Frequent Travelers: People who travel often may face the risk of connecting to insecure networks, like public Wi-Fi, where phishing attacks and malicious websites are common. Haven provides an extra layer of security, ensuring that no matter where you are, you’re connected to the right website.

- Tech-Savvy Users: With its seamless integration into your browser, Haven is designed to work automatically without requiring users to manage complex settings. This makes it ideal for users who want smart, passive security without the hassle of manual intervention.

The demand for security solutions tailored to online banking is high, and users who prioritize their privacy and financial security will likely embrace Haven. Its simplicity and targeted protection are its key selling points. In addition to protecting users from the risk of fraud, Haven is easy to install and operate, making it an appealing solution for a broad audience.

4. Rating Haven: Can It Survive and Thrive Over the Next Year?

Looking ahead, I would rate Haven 4 out of 5 stars for its potential in the next year. Haven has a lot to offer in terms of addressing the specific vulnerabilities of online banking, but like any product, it comes with its risks and challenges. Let’s break it down.

Rating: 4/5 Stars

Risks:

-

Competition from Established Security Tools: Antivirus programs and other general online security tools already offer some protection against phishing and fake websites. While Haven is more targeted, convincing users to adopt a new security tool, especially when they already have existing solutions in place, might be challenging.

-

User Awareness and Education: Despite its straightforward functionality, users may not immediately understand the value of Haven or be willing to install yet another browser extension. The company will need to work on educating users about how purpose-built protection can address the unique risks of online banking.

-

Scaling and Integration: As the platform grows, Haven will need to ensure it can scale effectively without slowing down the browsing experience or causing compatibility issues with other extensions. Maintaining a seamless user experience while adding new features is crucial for long-term success.

Opportunities:

-

Increased Awareness of Online Security Risks: As more people fall victim to phishing scams and online banking fraud, the demand for tools like Haven will likely grow. By positioning itself as a specialized security solution for banking, Haven can fill a specific gap in the market.

-

Expansion into Mobile: While Haven currently works as a browser extension, expanding its functionality to mobile devices and apps could further increase its reach. As more users conduct financial transactions on their phones, this could be a crucial development for Haven’s success.

-

Partnerships with Banks and Financial Institutions: By partnering with banks and offering Haven as a value-added security feature, the app could gain more exposure and trust among users. This would also help solidify Haven’s position as a trusted security solution.

Conclusion

Haven provides a targeted, efficient solution for online banking security, focusing on the unique risks of phishing, fake websites, and fraudulent links. With its simple, user-friendly design, Haven makes securing your banking experience easier than ever, giving users confidence in their online transactions.

While Haven faces competition from broader security tools and the challenge of educating users on its benefits, it stands out by providing specialized, context-aware protection for online banking. If it can continue to educate users, expand its features, and grow its presence, Haven has the potential to become an essential tool for those seeking a safer way to manage their finances online.

Final Rating: 4/5 Stars. Haven is a promising tool with significant potential, especially as more users become aware of the need for better protection in the digital banking space.