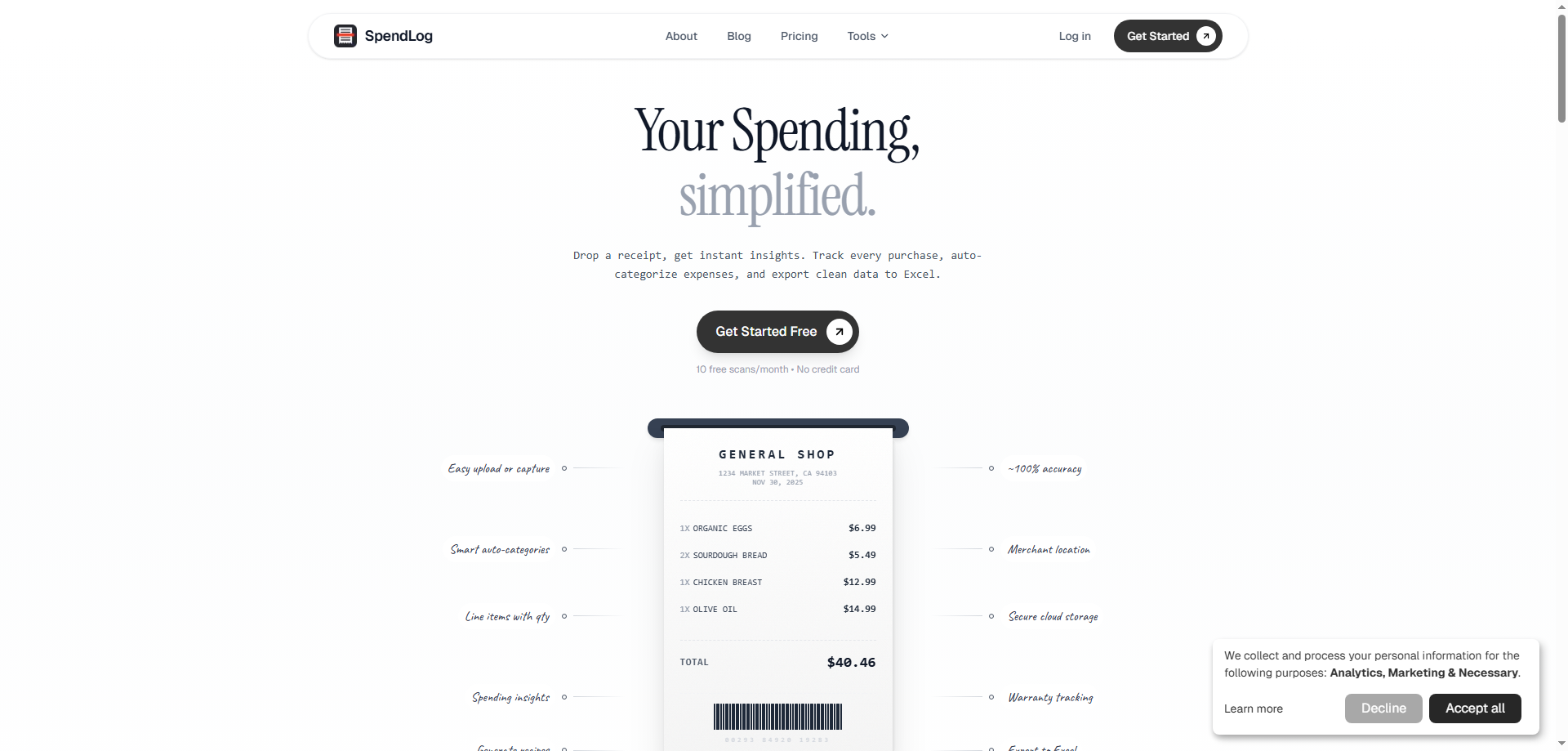

1. Creative Take on SpendLog: A New Way to See Your Spending

When it comes to tracking our spending, most financial apps and tools offer the basics: total spent, a lump sum for a category, and maybe a few rough estimates. But what if we could dig deeper and understand exactly where our money goes—down to every single item on a receipt? That’s where SpendLog comes in, and it’s a game-changer.

SpendLog isn’t just about telling you the total amount spent; it’s about giving you full visibility into each purchase you’ve made. Imagine you’ve just come back from a shopping trip, and you want to track your expenses. Instead of manually entering each item into a budget sheet or app, SpendLog uses its smart technology to scan and extract each item from your receipt with near 100% accuracy. It’s like having a personal assistant that knows exactly what you bought, right down to every grocery, gadget, or gift.

What makes SpendLog even more impressive is its ability to do more than just financial tracking. It brings together a variety of useful features in one neat app—warranty tracking, expense categorization, Excel exports, and even recipe generation from your grocery list. It transforms your receipts into actionable insights, helping you manage everything from budgeting to meal planning.

Key Features:

- Line Item Extraction: Automatically identifies every item on a receipt, making your spending analysis incredibly granular and detailed.

- Warranty Tracking: Never forget about warranties again. SpendLog tracks items that typically come with warranties, like electronics, so you can take advantage of support if needed.

- Clean Excel Data Export: Provides easily digestible spreadsheets to simplify the process of importing data into other financial tools or for business record-keeping.

- Auto-Categorization: Automatically assigns your purchases to relevant categories like groceries, utilities, or entertainment, saving you the time and effort of manually categorizing your expenses.

- Grocery List Recipe Generation: Turns your grocery purchases into meal ideas, helping you reduce food waste and plan meals more effectively.

2. Disruption: Can SpendLog Replace Existing Financial Tools?

SpendLog is not just another expense tracker—it’s a disruptive tool that goes above and beyond what we currently use to manage our finances. Most traditional expense-tracking apps simply focus on categorizing spending into broad categories like “groceries” or “entertainment,” leaving out the finer details of exactly what was bought. While useful for general budgeting, this approach doesn’t give you the full picture.

SpendLog, on the other hand, addresses this by extracting every individual item from your receipts, making it possible to track each purchase precisely. This level of detail is something that traditional financial management tools often lack, making SpendLog a potential game-changer for anyone looking to gain deeper insights into their spending habits.

Furthermore, its unique ability to track warranties could set SpendLog apart from other financial management tools. Many people forget about warranties for products like electronics or home appliances, and having a tool that automatically keeps track of them could save users money and frustration down the line.

SpendLog also introduces the concept of turning grocery receipts into recipe ideas. This may seem like a small feature, but it’s a clever way to tackle food waste by giving users meal planning inspiration based on what they’ve just bought. This could potentially make SpendLog the go-to app not only for managing finances but for smart, sustainable living.

While there are other apps that handle receipt scanning or budgeting, none seem to offer the same comprehensive package as SpendLog. It’s an all-in-one solution for not just tracking what you spend, but also for making sure you’re using your purchases wisely and efficiently.

3. Demand: Will Users Embrace SpendLog?

The demand for SpendLog is likely to be high, especially among users who care about personal finance, sustainability, and convenience. Let’s face it: we’ve all had moments where we’ve bought something, forgotten about it, and later realized we could have used it in a recipe or could’ve taken advantage of a warranty. SpendLog solves these problems and more.

Consider the following scenarios where SpendLog would be invaluable:

- Personal Finance Enthusiasts: People who are passionate about managing their finances will appreciate SpendLog’s detailed breakdown of expenses. Knowing exactly what you’ve bought, and being able to categorize and track it, can help users make smarter decisions about their money.

- Busy Professionals: For people who don’t have the time or patience to manually input receipts into an app or spreadsheet, SpendLog’s line item extraction feature makes it effortless. Professionals who need to track their expenses for business purposes can also benefit from the clean Excel export feature, saving them hours of work each month.

- Home Cooks and Meal Planners: Grocery shopping can be overwhelming, and meal planning even more so. By turning grocery lists into recipe ideas, SpendLog appeals to anyone looking to reduce food waste and plan meals with minimal effort. It’s the perfect tool for people trying to eat more mindfully and avoid buying unnecessary ingredients.

- Sustainability Advocates: SpendLog’s ability to generate recipes from grocery receipts encourages mindful consumption and helps reduce food waste. For users who care about sustainability, this feature is particularly appealing because it combines financial tracking with eco-conscious living.

Ultimately, SpendLog speaks to people who want to have a clearer picture of their finances, simplify their record-keeping, and even get more out of their purchases. By offering a mix of financial management, time-saving features, and practical, everyday solutions, SpendLog caters to a wide range of potential users.

4. Rating SpendLog: Can It Survive and Thrive in the Next Year?

Let’s look at how likely it is for SpendLog to survive and thrive over the next year. I’d give SpendLog a solid 4 out of 5 stars for its potential, but it does face a few risks.

Rating: 4/5 Stars

Risks:

-

Competition in the Expense-Tracking Space: There are a lot of players in the personal finance and expense-tracking market. Popular tools like Mint, YNAB (You Need a Budget), and even the built-in budgeting tools in banking apps could pose competition. These apps already have large user bases and established features, which might make it difficult for SpendLog to stand out initially.

-

User Education and Adoption: While SpendLog offers unique features, getting users to embrace it could be a challenge. Many people are used to the traditional, basic expense tracking methods, and they may not immediately see the value in detailed line item tracking or warranty management. Educating users about the benefits of these features will be key.

-

Data Privacy and Security: Given that SpendLog processes receipts, it will need to ensure top-notch data security, especially since users will be uploading sensitive financial information. Any lapses in data security could deter potential users from adopting the app.

Opportunities:

-

Expansion of Features: If SpendLog continues to improve its features, especially in areas like tax reporting or deeper integrations with other financial tools, it could carve out a unique niche in the personal finance space. Additionally, adding more customization options for categories or integrating with other budgeting apps could increase its appeal.

-

Growing Trend of Sustainability and Waste Reduction: As sustainability becomes an increasingly important issue, SpendLog’s ability to generate recipes from grocery lists could attract more users who are conscious about food waste. This could set SpendLog apart as not just a financial tool, but a holistic, eco-friendly app.

-

Business Use: Small business owners could find SpendLog’s ability to extract and categorize receipts especially helpful for expense reporting. This could be a lucrative market if SpendLog optimizes its features for business users, potentially increasing its adoption in the professional space.

Conclusion

SpendLog is a unique tool that provides detailed insights into your spending and helps you manage everything from budgeting to warranty tracking, all with a clean, user-friendly interface. While it faces competition from other finance apps, its innovative features, especially the line item extraction and grocery list recipe generation, set it apart from traditional financial tools. With privacy at its core, SpendLog is well-positioned to appeal to privacy-conscious users and those looking for a more granular approach to managing their finances.

Final Rating: 4/5 Stars. SpendLog is on the right track, but it will need to continue to innovate and educate users to stay ahead of the competition. With the right improvements and marketing, it has a bright future.