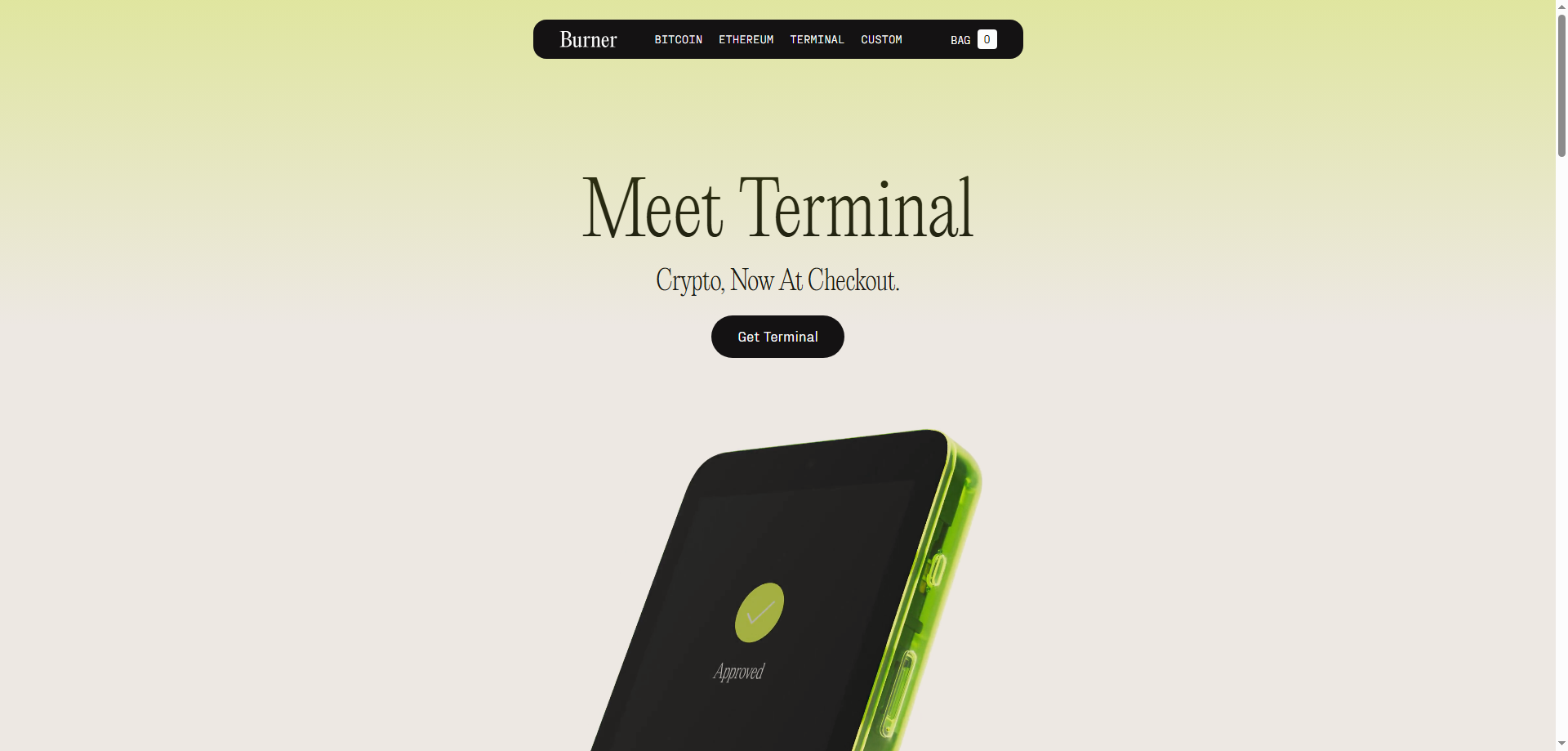

1️⃣ From a Creative Perspective: Turning Crypto Payments Into a Tap

When I first saw Burner Terminal, I thought: Finally, someone made crypto feel human.

No complicated wallet addresses, no QR scanning, no awkward waiting. Just a tap-to-pay experience — like Apple Pay, but with stablecoins.

From a creative standpoint, this is brilliant because it solves the biggest emotional gap in crypto payments: friction. People love the idea of paying with crypto, but the process? Way too clunky. Burner Terminal fixes that by blending the physical world of commerce with the digital precision of blockchain.

Imagine running a small café, a vintage shop, or a pop-up stand. A customer waves their phone, and — click — USDC on Base network transfers directly to your account. No middlemen, no delayed settlements, no chargeback nightmares.

Creatively, it’s not just hardware. It’s a philosophy of simplicity — a design that hides the complexity of Web3 beneath the smooth, familiar gesture of tapping.

Burner Terminal bridges two worlds: crypto’s freedom and real-world usability. For the first time, I can actually feel what a decentralized economy might look like — fast, human, and beautifully frictionless.

2️⃣ From a Disruptive Perspective: Could It Replace Traditional Payment Terminals?

Let’s be real — the payment space is one of the toughest to disrupt. Square, Stripe, and PayPal dominate because they own the trust layer.

But here’s where Burner Terminal breaks through: it removes the trust problem entirely.

In traditional systems, chargebacks, fees, and settlement delays are accepted as “just how it works.” With stablecoins like USDC, none of that applies. Once the payment goes through, it’s final. For small businesses tired of paying 3% to intermediaries, that’s revolutionary.

It’s also multi-modal. You’re not forced into crypto-only payments — Burner Terminal still supports Visa and Mastercard. That means merchants don’t have to choose between future and present. They get both.

Disruptively speaking, this could become the Square Terminal of Web3. The first point-of-sale device that natively supports decentralized money.

The tech world has been saying “crypto payments are the future” for a decade. Burner Terminal quietly makes it the present.

Will it replace traditional POS systems? Maybe not overnight — but it doesn’t need to. It just needs to coexist long enough for stablecoin adoption to rise. Once that happens, this device will be the bridge every business needs.

In short: this isn’t just a hardware innovation — it’s a financial paradigm shift disguised as a payment terminal.

3️⃣ From a Market Needs Perspective: Why People Actually Want This

When I talk to small business owners, I hear the same thing over and over:

“Crypto sounds great, but I don’t have time to figure it out.”

That’s exactly the pain Burner Terminal solves. It doesn’t ask businesses to “learn crypto.” It just lets them use it like they already use contactless payments.

For merchants, the value is instant:

- No chargebacks. Once paid, the money’s yours.

- Lower fees. Stablecoin transfers cost pennies compared to credit cards.

- Cross-border ease. Tourists and freelancers can pay in USDC without currency headaches.

- Same-day settlement. No waiting for funds to clear.

For customers, it’s equally intuitive:

- No app juggling.

- No network confusion.

- No wallet QR anxiety.

They simply tap and go — and that’s the entire magic.

This makes adoption a no-brainer for three big audiences:

- Crypto-native users who already hold stablecoins and want a real-world use case.

- Small businesses tired of losing margins to intermediaries.

- Travelers and digital nomads who deal with multiple currencies.

The acceptance curve here is steep because the need is tangible — not theoretical. Stablecoins are already mainstream in parts of Latin America, Africa, and Asia for remittances and commerce. Burner Terminal just gives that momentum a clean, accessible interface.

And the best part? It doesn’t force a financial revolution — it quietly makes one usable.

4️⃣ From a Survival Perspective: ⭐️⭐️⭐️⭐️☆ (4.8/5)

I’d rate Burner Terminal’s one-year survival and growth prospects at a confident 4.8 out of 5 stars.

It’s perfectly timed. The crypto hype cycle is cooling — which means the real builders are emerging. Stablecoins like USDC are now the “serious” side of crypto — backed, regulated, and enterprise-ready. That’s the world Burner Terminal was born for.

🌟 Opportunities

-

First-Mover Advantage It’s the first true “tap-to-pay for stablecoins” device. That’s huge in a market where every crypto payment still feels awkward.

-

Bridge Between Old and New Finance Supporting both credit cards and stablecoins means it appeals to everyone — from Web3 natives to traditional merchants.

-

Massive SMB Market Potential Millions of small businesses want cheaper, faster payment options — this gives them that with almost no friction.

-

Trust Through Tangibility Crypto often feels abstract. A physical terminal people can touch gives it credibility and everyday context.

⚠️ Risks

-

Regulatory Hurdles Stablecoin rules vary by country. Compliance frameworks will need to evolve fast to stay legally clean.

-

Adoption Lag Merchants may hesitate to accept crypto without clear tax and accounting support. Education is key.

-

Network Reliability It relies heavily on the Base network. If transaction speeds or fees spike, user trust could suffer.

-

Security Concerns As with any blockchain-connected device, secure firmware and anti-tampering protocols will be essential.

Still, these risks are manageable. The concept is so intuitive — “tap to pay in crypto” — that once a few businesses adopt it, viral curiosity will do the rest.

If executed well, Burner Terminal could become a gold standard in real-world crypto usability.

Final Thoughts: Why I Believe in Burner Terminal

I’ve used dozens of payment systems — from PayPal to Apple Pay to crypto wallets — and all of them had one flaw: friction. Burner Terminal finally removes it.

It’s crypto for normal people. It’s blockchain without buzzwords. It’s the future of payments that doesn’t ask you to change — it simply fits into how you already pay.

I see it becoming the go-to device for small merchants, the gateway for stablecoin adoption, and the symbol of how crypto finally goes mainstream — quietly, efficiently, and one tap at a time.

⭐️ Final Ratings:

- Creativity: 5/5 — Brilliantly merges physical simplicity with digital finance.

- Disruption: 5/5 — Bridges the gap between traditional and decentralized payments.

- User Acceptance: 5/5 — Perfect for merchants and consumers who want convenience.

- Survival Potential: 4.8/5 — Strong timing, scalable model, manageable risks.

In one line: Burner Terminal makes stablecoin payments feel as natural as tapping a card — simple, fast, and built for the real world.