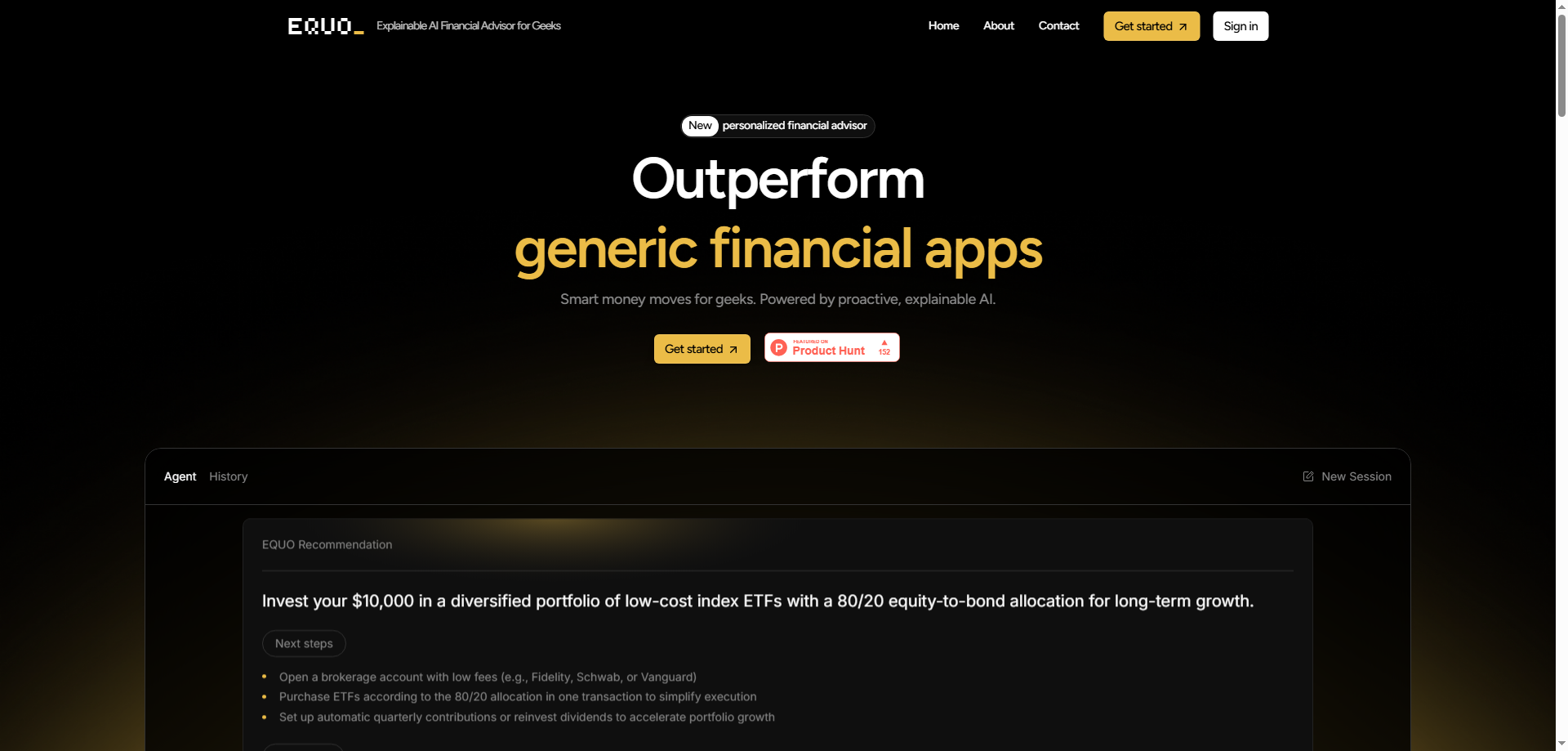

1) Creative angle: how I turn money data into clear, geek-friendly actions

EQUO feels like a personal finance assistant that speaks my language. I link my bank and brokerage accounts, set goals, and let its multi-agent brain translate noise into data-driven decisions I can actually defend. It doesn’t just say “buy this ETF”—it shows the why: risk, fees, drawdowns, and trade-offs in plain English. I riff on ideas like a true AI finance nerd:

- “What’s the fastest path to my down payment?” → EQUO builds a financial planning path and explains every assumption.

- “Is my portfolio too spicy?” → It runs scenario checks and suggests intelligent investing tweaks with clear, explainable AI rationale.

- “Can cash flow breathe?” → It flags wasteful spend, proposes rules, and automates transfers so automated investing happens on time. The vibe is collaborative: I ask; it answers—with receipts. That’s the kind of personalized financial advice I’ll actually follow.

2) Disruptive angle: could EQUO replace my current stack?

For a lot of day-to-day work, yes. EQUO compresses budgeting apps, portfolio checkers, and DIY spreadsheets into one fintech cockpit that’s proactive, explainable, and goal-driven. What it can realistically replace for me

- Budget trackers that spot patterns but can’t turn them into data-driven decisions.

- Generic robo tips that lack context; EQUO’s personalized financial advice is tied to my goals.

- Manual rebalancing reminders with rules-based automated investing nudges.

What I still keep

- Tax software and a human CPA for edge cases.

- Brokerages for trade execution (EQUO advises; accounts execute). Net-net: EQUO won’t replace a fiduciary for complex estate planning, but for everyday AI finance and financial planning, it’s the control center I open first.

3) Exact-need angle: will users really adopt it?

I think yes—especially geeks, DIY investors, freelancers, and product-minded folks who want transparent logic. Adoption hinges on three things EQUO leans into:

- Explainability: every suggestion comes with a because—assumptions, risk, and alternatives.

- Personalization: goals, timelines, risk tolerance, and cash-flow quirks shape intelligent investing paths.

- Proactivity: it doesn’t wait; it spots drift, over-spend, and missed contributions, then nudges automated investing or budget fixes. If you’ve ever rage-quit a black-box robo or got lost in spreadsheets, a personal finance assistant that’s both opinionated and defensible is easy to love.

4) 12-month survival score: 4.3 / 5 stars

Verdict: Strong odds EQUO grows over the next year. The wedge—explainable AI plus proactive, personalized financial advice—targets a real gap between budgeting toys and opaque robos.

Opportunities

- Deeper brokerage/bank connections to streamline automated investing and cash sweeps.

- Goal simulators (retirement, housing, education) that turn financial planning into interactive trade-off maps.

- Safety rails: anomaly alerts, contribution calendars, and “what-if” stress tests for true data-driven decisions.

- Community templates for geeky workflows (lazy portfolios, barbell, liability-matching).

Risks

- Data aggregation & security: account connectivity or privacy missteps kill trust fast.

- Regulatory boundaries: advice vs. guidance lines matter across regions.

- Model drift/hallucination: even explainable AI needs guardrails and human overrides.

- Incumbent pressure: banks/robos may ship “good-enough” explainability.

What would lift it to 4.6–4.8 Audit trails for every recommendation, SOC-level security proofs, tax-aware rebalancing, and execution integrations that make “plan → trade” truly seamless.

Why I’m using it

I want AI finance that earns my trust. EQUO connects my accounts, explains its reasoning, and turns goals into data-driven decisions—from budget fixes to intelligent investing moves. It’s the personal finance assistant I’ve been waiting for: proactive, opinionated, and crystal clear.