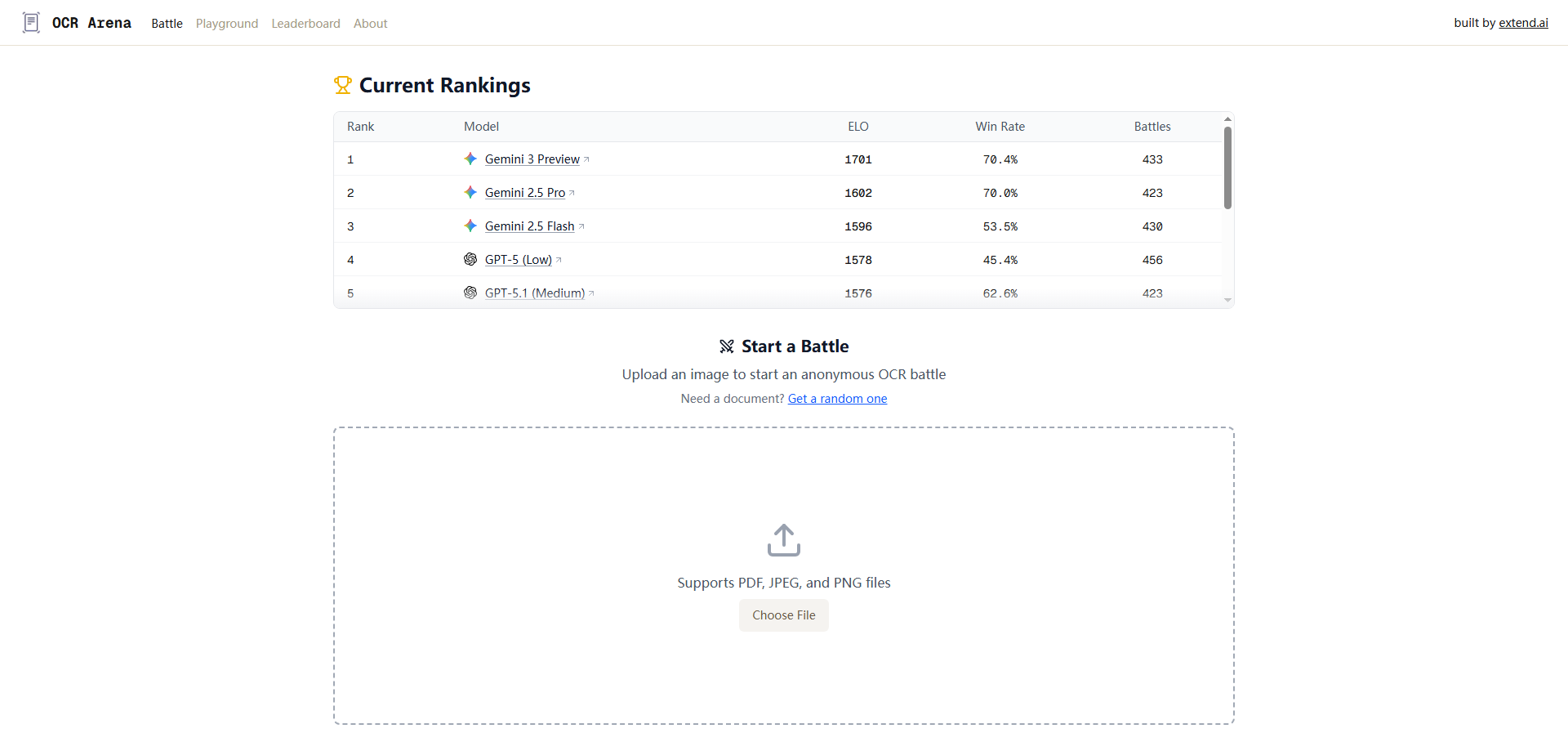

The Creative Concept Behind AI-Powered Brand Perception

Let me be upfront about my initial reaction to Gemini 3 Brand Audit: I was intrigued by the concept but immediately skeptical about execution. The creative idea here is genuinely interesting—using AI as a lens to understand brand perception—but it's also quite narrow in scope. Let me explain why there's creative merit despite the limitations.

The core creative insight is treating AI models as proxy audiences for brand analysis. Instead of conducting expensive focus groups or surveys, Gemini 3 Brand Audit asks: what does Google's Gemini 3 AI actually understand about your brand? That's a clever shortcut for brand analysis because AI models are trained on vast amounts of public data, theoretically capturing collective online sentiment and information about brands.

What I find creatively interesting is the timing of this approach. As AI becomes increasingly influential in how people discover and evaluate brands—through AI search, recommendations, and assistants—understanding how AI models perceive your brand becomes genuinely important. Gemini 3 Brand Audit is essentially saying: "AI is becoming a gatekeeper for brand discovery, so let's audit how that gatekeeper sees you." That's forward-thinking creativity.

The competitor analysis angle adds creative value. By showing how Gemini 3 understands your competitors alongside your own brand, the tool provides comparative context that helps identify positioning gaps or differentiation opportunities. That's smart because brand perception is inherently relative—your strengths and weaknesses only matter in comparison to alternatives.

However, the creative limitations are significant. The tool appears to focus exclusively on Gemini 3's understanding, which raises questions: why only Gemini 3? What about ChatGPT, Claude, or other AI models that users might interact with? The narrow focus on a single AI model limits the creative comprehensiveness of the brand audit.

The simplicity of the concept is both creatively appealing and limiting. On one hand, the straightforward value proposition—"see what Gemini 3 knows about your brand"—is easy to understand and act on. On the other hand, this simplicity suggests limited depth. What actionable insights does this actually provide beyond basic brand awareness checks?

What I appreciate creatively is the democratization angle. Traditional brand audits require expensive consulting firms or extensive in-house market research capabilities. Gemini 3 Brand Audit appears to offer a quick, accessible way for smaller businesses to get AI-driven brand insights without significant investment. That's creative problem-solving for resource-constrained marketers.

The AI perspective framing is creatively clever too. Instead of just another market analysis tool, positioning this as understanding "AI's perspective" makes it feel novel and aligned with current technology trends. It taps into marketers' anxiety about AI disruption while offering a concrete tool to address that anxiety.

However, I wish the creative execution went deeper. Imagine if Gemini 3 Brand Audit not only showed what the AI knows but also simulated how the AI would respond to various customer queries about your brand versus competitors. Or if it identified specific content gaps where your brand lacks information compared to competitors. Those would be more creatively ambitious implementations of the core concept.

The Product Hunt reception (206 votes, 12 discussions) suggests modest creative resonance. The market isn't wildly excited, which might indicate the creative concept, while interesting, doesn't feel urgent or transformative enough to generate buzz. That's important feedback about whether the creative angle truly addresses a burning need.

Can This Actually Disrupt Traditional Brand Analysis Tools?

Here's where I need to be honest: I'm skeptical about Gemini 3 Brand Audit's ability to significantly disrupt existing brand analysis and market research tools. Let me explain why, while also identifying where it might carve out a niche.

Traditional brand analysis involves multiple methodologies: consumer surveys, focus groups, social media listening, search analytics, brand tracking studies, and competitive intelligence platforms. These tools provide comprehensive, multi-dimensional views of brand perception across actual human audiences. Gemini 3 Brand Audit offers something fundamentally different: one AI model's understanding of your brand.

Can this replace comprehensive brand analysis? Absolutely not. Understanding what Gemini 3 knows about your brand is interesting data, but it's not a substitute for knowing what actual customers think, feel, and say about your brand. AI models reflect their training data, which might include outdated information, biases, or gaps that don't represent current market reality.

However, could Gemini 3 Brand Audit disrupt specific use cases? Possibly. For quick brand awareness checks or competitive intelligence gathering, asking an AI might be faster and cheaper than traditional methods. If I'm a startup founder wanting to quickly understand how AI describes my competitors, this tool could provide instant insights without hiring a market research firm.

The potential disruption lies in speed and accessibility, not comprehensiveness. Traditional brand audits take weeks or months and cost thousands of dollars. If Gemini 3 Brand Audit delivers instant results at a fraction of the cost, it could disrupt the low-end market research segment where businesses need quick directional insights rather than deep analysis.

For AI-optimized brand positioning, there's genuine disruption potential. As more consumers use AI assistants for product recommendations and research, understanding how AI describes your brand becomes strategically important. Gemini 3 Brand Audit addresses this emerging need that traditional tools ignore. If your brand doesn't exist in AI's knowledge base or is described inaccurately, you have a problem that traditional brand tracking won't reveal.

But the single-model limitation severely constrains disruption potential. Why would I trust insights from only Gemini 3 when consumers use ChatGPT, Claude, Perplexity, and other AI models? A truly disruptive tool would analyze brand perception across multiple AI platforms, showing how different models understand your brand differently.

Established competitive intelligence platforms like Crayon, Klue, or Kompyte provide comprehensive competitor tracking with features like sales battlecards, product comparisons, and win-loss analysis. Gemini 3 Brand Audit can't replace these sophisticated platforms with its simple AI query approach.

Social listening tools like Brandwatch or Sprout Social analyze real conversations about brands across social media, news, reviews, and forums. They provide sentiment analysis, trending topics, and audience demographics. Understanding Gemini 3's knowledge doesn't replicate these real-world perception insights.

Brand tracking studies measure awareness, consideration, preference, and loyalty over time with statistically significant sample sizes. Gemini 3 Brand Audit provides a snapshot of one AI's understanding at one moment—useful context, but not rigorous brand measurement.

Where I do see disruption potential is in the emerging category of AI brand optimization. Just as SEO became essential when Google dominated search, "AI optimization" might become critical as AI mediates brand discovery. Gemini 3 Brand Audit could be an early tool in this new category, even if its current implementation is limited.

So my honest assessment: Gemini 3 Brand Audit won't disrupt comprehensive brand analysis tools, but it might create a niche in AI brand perception monitoring. It's a supplementary tool, not a replacement, addressing an emerging need that traditional tools don't cover.

Will Marketers Actually Find This Useful Enough to Adopt?

This is where things get tricky. The user acceptance question for Gemini 3 Brand Audit hinges on whether marketers see enough value in understanding one AI model's brand perception to actually use the tool. I'm cautiously pessimistic about widespread acceptance.

Let's start with the positive acceptance factors. The problem Gemini 3 Brand Audit addresses is increasingly relevant. As AI becomes more prevalent in consumer research and decision-making, marketers legitimately need to understand how AI systems represent their brands. That's a real, growing concern that could drive acceptance among forward-thinking marketers.

The ease of use likely helps acceptance. Based on the description, you simply input your brand name and get insights about how Gemini 3 understands your brand and competitors. That's low friction compared to complex market research tools requiring extensive setup and training. Quick, easy insights appeal to busy marketers.

The curiosity factor might drive initial trial. Marketers are generally curious about new tools and perspectives on their brands. The novelty of seeing "what AI thinks" about your brand could generate trial usage, even if ongoing adoption is uncertain.

For small businesses and startups with limited research budgets, Gemini 3 Brand Audit might find acceptance as an affordable alternative to expensive brand audits. If the pricing is accessible, entrepreneurs and small marketing teams might use it for quick competitive intelligence gathering.

However, the acceptance barriers are substantial. The 206 Product Hunt votes and only 12 discussions suggest modest interest even among the early-adopter tech community. If the product isn't generating excitement among Product Hunt users, broader marketer acceptance seems questionable.

The actionability question looms large: so what if I know what Gemini 3 thinks about my brand? What do I actually do with that information? Unless the tool provides clear, actionable recommendations based on the AI's understanding, marketers might view it as interesting but not useful enough to incorporate into regular workflows.

The single-model limitation significantly impacts acceptance. Savvy marketers will immediately ask: "Why just Gemini 3? What about ChatGPT, which has way more users? What about Claude or Perplexity?" The narrow focus feels incomplete, which could prevent acceptance among sophisticated users who want comprehensive AI brand analysis.

The reliability and accuracy concerns affect acceptance too. How do I know Gemini 3's understanding is accurate or representative? AI models have known limitations—they can be outdated, biased, or simply wrong. Marketers might not trust brand insights from a single AI query without validation from other sources.

Integration with existing workflows matters for acceptance. If Gemini 3 Brand Audit exists as a standalone tool without connecting to CRM systems, marketing automation platforms, or analytics dashboards, it becomes yet another isolated tool to remember to check. Marketers already struggle with tool proliferation.

The value-versus-cost equation is unclear without knowing the pricing model. If this is a free tool, acceptance improves significantly as a "why not check it occasionally" resource. If it requires subscription fees, marketers will compare the value against alternatives like direct AI queries or traditional research tools.

The lack of comparative benchmarking might limit acceptance. Marketers love benchmarks—how does my brand awareness compare to industry averages? How does my AI presence stack up against typical competitors? Without this context, the absolute insights feel less meaningful.

Enterprise marketing teams with established research processes might resist adoption entirely. They have relationships with research firms, subscriptions to competitive intelligence platforms, and established methodologies. Convincing them to add Gemini 3 Brand Audit to their toolkit requires demonstrating unique value that existing tools don't provide.

But here's where I see potential acceptance: as a quick sanity check tool. Before launching products, updating positioning, or entering new markets, marketers might use Gemini 3 Brand Audit for rapid AI perception checks. Not as comprehensive research, but as a quick "what does AI know about us?" verification step.

I predict acceptance will be limited to curious early adopters, small businesses seeking affordable insights, and marketers specifically focused on AI optimization strategies. Mainstream adoption among enterprise marketing teams seems unlikely without significant product evolution.

My Survival Rating and Realistic Future Outlook

Alright, time for my honest assessment. I'm giving Gemini 3 Brand Audit 2.5 out of 5 stars for survival probability over the next year. This is one of the lower ratings I've given, and I want to explain why while being fair about the challenges this product faces.

Why I'm giving only 2.5 stars (the significant concerns):

The product concept is extremely narrow. Understanding one AI model's brand perception is interesting but not comprehensive enough to build a sustainable business. Without rapid expansion to analyze multiple AI models, the value proposition remains limited.

The competitive moat is essentially nonexistent. What prevents competitors from building similar tools? What stops someone from simply prompting Gemini 3 directly about brands rather than using this tool? The technical barrier to entry appears very low, which threatens survival through commoditization.

The market validation is weak. With only 206 Product Hunt votes and 12 discussions, the initial reception suggests modest market interest. For a tool to survive, it needs enthusiastic early adopters who become advocates. The muted response is concerning.

The monetization path is unclear. How does Gemini 3 Brand Audit generate revenue? Subscription fees seem hard to justify for such limited functionality. Freemium models might struggle to convert users who can get similar insights by directly using AI. Without clear business model viability, survival is questionable.

The dependency on a single AI model creates existential risk. If Google changes Gemini's API access, pricing, or capabilities, the entire product could break. Building a business on someone else's platform without control is inherently risky.

The product differentiation from direct AI usage is marginal. Sophisticated users might simply prompt Gemini 3 (or other AI models) directly about brand perceptions rather than using a specialized tool. The added value needs to be more substantial to justify separate tool adoption.

Why I'm not giving lower (the slim positive factors):

The timing aligns with growing AI adoption trends. As AI becomes more influential in consumer decision-making, tools that help brands optimize for AI visibility have potential market relevance.

The low apparent development complexity means the tool probably doesn't require massive ongoing investment to maintain. If it's essentially wrapping Gemini API calls with analysis, operating costs might be manageable even with modest revenue.

The niche focus could work if positioned correctly. Rather than trying to compete with comprehensive brand analysis platforms, focusing specifically on AI brand optimization for a specific customer segment could create a sustainable niche.

The potential for quick pivots exists. If the current implementation doesn't gain traction, the team could presumably expand to multi-model analysis, add more features, or reposition relatively quickly given the product's simplicity.

The risks threatening survival:

Market education requirements are substantial. Most marketers don't yet think about optimizing for AI brand perception. Educating the market while simultaneously proving product value is extremely challenging for resource-constrained startups.

User retention seems questionable. Even if marketers try the tool out of curiosity, what drives them to use it regularly? Without frequent use cases, the product might see high churn and low engagement.

The feature set appears too limited for sustainable pricing. It's hard to imagine marketers paying significant subscription fees monthly for what appears to be simple AI queries about their brands.

Competition from free alternatives threatens viability. Google could easily build similar brand analysis features directly into Gemini. ChatGPT could add brand comparison capabilities. Why pay for a third-party tool when AI platforms might offer similar features for free?

The lack of network effects limits defensibility. Unlike platforms where more users create more value, Gemini 3 Brand Audit doesn't seem to benefit from network effects. Each user's brand analysis is independent, creating no compounding advantages.

The opportunities that could improve survival:

Expansion to multi-model analysis would dramatically increase value. If the product evolved to compare how ChatGPT, Claude, Gemini, Perplexity, and other AI models understand brands, it becomes significantly more compelling and defensible.

Integration with content strategy tools could create new value. Imagine if Gemini 3 Brand Audit identified specific content gaps and generated recommendations for improving AI brand understanding. That actionable output would justify subscription fees.

Enterprise features for brand management could open new markets. Offering team collaboration, historical tracking, automated monitoring, and reporting could appeal to larger organizations willing to pay for comprehensive AI brand management.

Partnership opportunities with marketing platforms might provide distribution. Integrating with HubSpot, Salesforce, or other marketing tools as a brand intelligence feature could accelerate adoption through existing user bases.

White-label opportunities for agencies might generate revenue. Marketing agencies could use the tool to provide AI brand audits as a service to their clients, creating B2B2C revenue streams.

The bottom line:

I'm giving 2.5 stars because while the concept has merit and addresses an emerging need, the execution appears too limited and the market validation too weak to inspire confidence in survival. The product needs significant evolution—expanding to multiple AI models, adding actionable features, proving clear ROI, and establishing a viable business model—to have strong survival odds.

For survival, the team needs to quickly:

- Validate whether anyone will actually pay for this

- Expand beyond single-model analysis to multi-AI brand auditing

- Add features that make insights actionable, not just informative

- Find product-market fit with a specific customer segment willing to pay

- Build defensibility through unique data, integrations, or methodology

Without rapid evolution and clearer market traction, I worry Gemini 3 Brand Audit might become one of many "interesting idea but couldn't find sustainable business model" casualties in the crowded marketing tools landscape.

Final Thoughts on AI Brand Perception Tools

After examining Gemini 3 Brand Audit honestly, I keep returning to one insight: understanding how AI perceives brands is genuinely important for the future, but this particular implementation feels too narrow to capture that opportunity fully.

The core concept—that brands need to understand and optimize how AI systems represent them—is absolutely correct. As AI mediates more consumer research and decision-making, AI brand perception matters increasingly. But addressing that important need requires more comprehensive solutions than querying a single AI model.

I want to be clear: I'm not dismissing the team's effort or creativity. Building any product is hard, and identifying emerging market needs shows insight. The execution just feels incomplete relative to the opportunity size.

For marketers wondering whether to try Gemini 3 Brand Audit, my advice is: if it's free or very cheap, absolutely check it out for curiosity and quick insights. But don't expect it to replace comprehensive brand analysis or provide deeply actionable intelligence in its current form.

For the product team, if you're reading this: the core insight is valuable. The market need is real and growing. But the product needs significant evolution to capture that opportunity. Multi-model analysis, actionable recommendations, historical tracking, and clear ROI demonstration would transform this from an interesting curiosity into an essential marketing tool.

The future of brand analysis will absolutely include understanding AI perception. The question is whether Gemini 3 Brand Audit evolves quickly enough to become a leading solution in that emerging category, or whether it remains a footnote while more comprehensive tools capture the market.