The Creative Genius of Automated Product Insight

When I first encountered Product Intelligence, I had one of those "why didn't anyone build this sooner?" moments. The creative brilliance here isn't in inventing something entirely new—it's in connecting two things that have always existed separately and making them work together seamlessly.

Here's the insight: product managers have always known that customer support tickets contain goldmines of product insights. Every complaint, every confusion, every workaround that users mention to support agents represents a potential feature request or product improvement opportunity. But here's the problem—those insights are buried in hundreds or thousands of individual support conversations, written in unstructured language, scattered across different support channels.

Meanwhile, on the other side of the company, engineering teams are constantly asking product managers: "Where's the evidence? How many users want this? Why should we prioritize this feature over that one?" Product managers know the answers intuitively from talking to customers and monitoring support, but translating that intuition into hard data that convinces engineers has traditionally required hours of manual analysis.

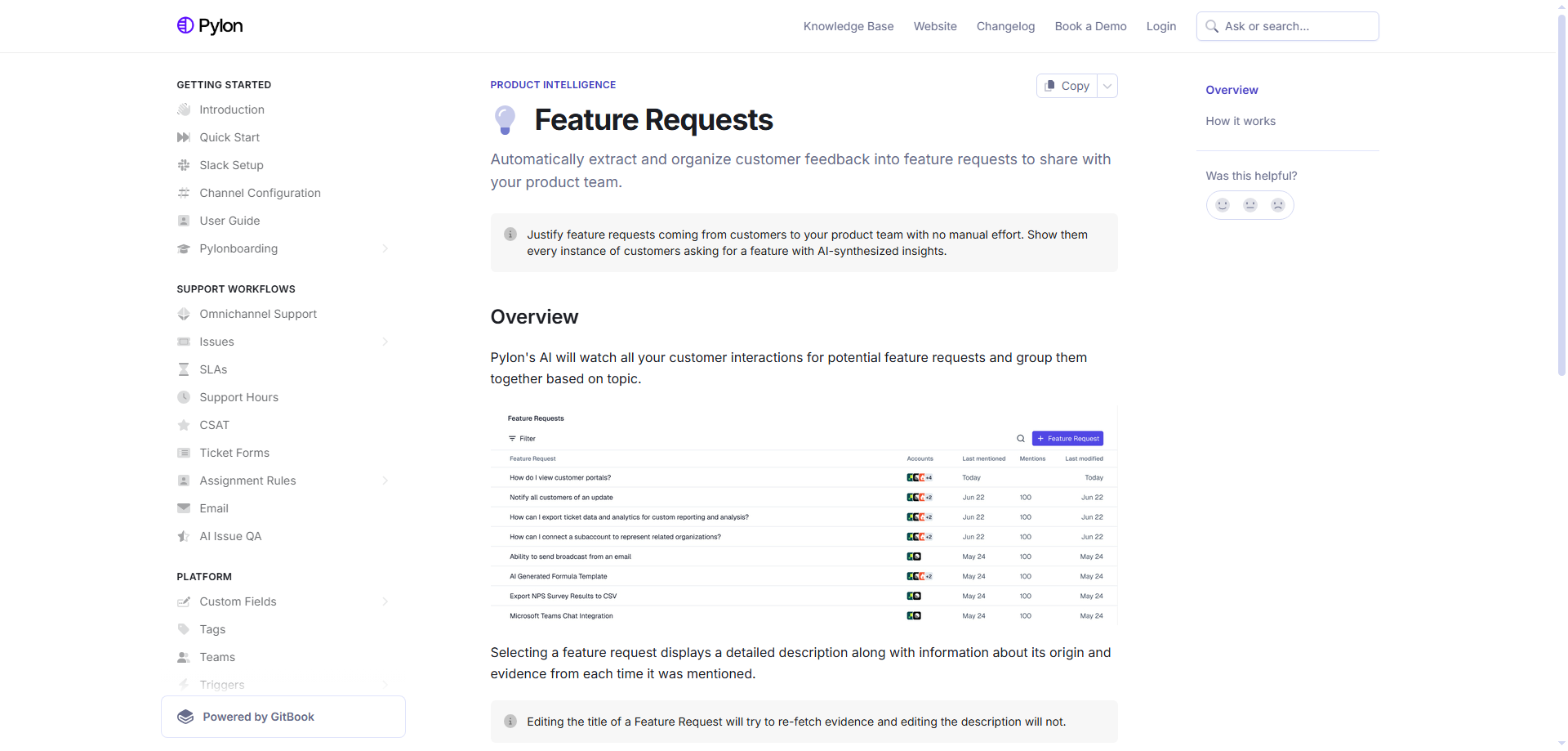

Product Intelligence's creative breakthrough is automating this entire translation process. Instead of a product manager spending days reading through support tickets, categorizing feedback, counting mentions, and building a case document, the AI does it automatically. It analyzes customer support tickets, identifies patterns, extracts feature requests, quantifies demand, and packages everything into evidence-backed proposals that engineering teams can actually work with.

What I find particularly clever is how Product Intelligence addresses the "conviction gap" between customer-facing teams and engineering teams. Customer success and support teams hear user pain every day and develop strong convictions about what needs to be fixed. Engineers, sitting further from customers, naturally want proof before investing time in new features. Product Intelligence bridges this gap by transforming qualitative feedback into quantitative evidence.

The automation aspect is crucial for creativity here. Manual ticket analysis isn't just slow—it's also prone to bias. A product manager might unconsciously overweight feedback from vocal users or recent conversations. AI analysis can process every single ticket objectively, identifying patterns that humans might miss and preventing loud minority opinions from drowning out silent majority needs.

I'm also impressed by how this tool changes the nature of product development communication. Instead of product managers saying "I think users want this feature," they can now say "Product Intelligence analyzed 500 support tickets and found 127 users experiencing this specific pain point, with 43 explicitly requesting this solution." That shift from opinion to evidence fundamentally changes product conversations.

The timing is creative too. We're living through an explosion of AI capabilities, but many AI tools feel like solutions looking for problems. Product Intelligence applies AI to solve a genuine, longstanding problem that every product team faces. That's smart positioning—riding the AI wave while addressing real pain rather than just adding "AI-powered" to something that doesn't need it.

From a workflow perspective, the creative value is in making product intelligence extraction passive rather than active. You don't need to run special surveys, conduct user interviews, or set up complicated feedback systems. Your support team is already having conversations with users every day. Product Intelligence just makes those existing conversations infinitely more valuable to product development.

Can Product Intelligence Replace Traditional Product Research?

This is where things get really interesting. Can automated support ticket analysis actually replace traditional methods of understanding user needs? Let me explore this from multiple angles because the answer is nuanced.

First, let's examine what Product Intelligence does better than existing approaches:

Versus manual ticket review: This one's obvious. A human product manager might review 20-30 support tickets to get a sense of emerging issues. Product Intelligence can analyze thousands in minutes, identifying patterns that would take weeks of manual work. The speed and scale advantages are undeniable. I can finish my morning coffee while the AI processes an entire quarter's worth of support data.

Versus user surveys: Traditional surveys suffer from several problems—low response rates, self-selection bias, leading questions, and the gap between what users say they want and what they actually need. Support tickets, by contrast, represent real problems users encountered organically. They weren't prompted to think about features—they hit actual pain points. This authentic feedback is arguably more valuable than survey responses.

Versus user interviews: Interviews provide deep qualitative insights but are time-intensive and don't scale. You might interview 10-15 users in a good month. Product Intelligence can extract insights from thousands of user interactions simultaneously. While interviews reveal "why" more deeply, Product Intelligence excels at revealing "what" and "how many" at scale.

Versus product analytics: Analytics tools show you what users do, but support tickets reveal what users struggle with and wish they could do. Analytics might show high drop-off at a certain step; support tickets explain why users are dropping off. The combination of both is powerful, but Product Intelligence fills a gap that analytics alone cannot.

However, can it truly replace traditional product research methods? I don't think so—at least not completely. Here's why:

Product Intelligence is inherently reactive. It analyzes problems users have already encountered. It's excellent for identifying friction in existing features but less effective for discovering entirely new opportunities or understanding latent needs users haven't articulated. True innovation often requires proactive research—understanding where the market is heading, not just where users are currently frustrated.

Support tickets also represent a biased sample. They come from users who experienced problems and bothered to contact support. Silent users who struggle and quit might never appear in this data. Power users who've learned workarounds might not report issues anymore. Product Intelligence can't surface insights from the users who never reach out.

Additionally, there's context that support tickets might not capture. A user might complain about feature X, but the underlying issue is actually their misunderstanding of the product's value proposition or poor onboarding—problems that require different solutions than building feature X.

That said, I believe Product Intelligence can substantially replace certain aspects of traditional product research:

For incremental improvements: If you're looking to optimize existing features, reduce friction, and fix usability issues, automated support ticket analysis might provide 80% of what you'd get from formal user research at 10% of the time and cost. That's transformative.

For prioritization decisions: When you have multiple potential features on your roadmap and need to decide what to build next, Product Intelligence can provide objective data about which problems affect the most users. This beats gut feeling or whoever argues most persuasively in product meetings.

For stakeholder alignment: Even if you conduct traditional research, having automated ticket analysis running continuously provides ongoing validation and real-time demand signals. You can build a feature based on user interviews, then monitor support tickets to see if it actually solved the problem.

The real disruption potential isn't Product Intelligence replacing other research methods but rather democratizing product insights across the organization. Traditionally, understanding user needs required dedicated product managers or researchers. With automated support ticket intelligence, customer success teams, support agents, and even engineers can access product insights directly. This could fundamentally change how product decisions get made—less top-down, more evidence-driven, more distributed.

I think we'll see Product Intelligence become a standard tool in every product team's stack, not as a replacement for product managers but as a powerful force-multiplier that lets product managers focus on higher-level strategy instead of drowning in ticket analysis.

User Acceptance: Will Product Teams Actually Use This?

From a practical needs perspective, I'm quite bullish on Product Intelligence's acceptance potential. The tool solves several genuine pain points that product teams experience daily, and the value proposition is immediately obvious. Let me break down why I think adoption will be strong.

The product manager perspective: I've worked with numerous product managers, and their most common complaint is that they spend too much time on coordination and communication instead of actual product strategy. Manually analyzing support tickets to build feature justification documents falls squarely in the "time-consuming but necessary" category. Any tool that automates this grunt work will be welcomed enthusiastically.

Product managers also face constant pressure to prove their decisions. Engineers want data. Executives want evidence. Sales teams want justification for why their pet feature isn't being built. Product Intelligence gives product managers an objective third party—the AI—to cite when making prioritization decisions. "It's not just my opinion; the data shows..." is a powerful phrase in product meetings.

The engineering team perspective: Engineers are naturally skeptical of feature requests that feel based on anecdotes or individual opinions. They've all experienced the frustration of building features that nobody ends up using. Product Intelligence addresses this skepticism by providing quantified evidence of demand. An engineer is far more likely to enthusiastically build a feature when they know exactly how many users are affected by the current problem.

Additionally, engineers appreciate clear, structured requirements. Product Intelligence converts messy, emotional support tickets into organized, specific feature proposals. This translation work—which product managers traditionally do manually—helps engineers understand exactly what needs to be built and why.

The customer success team perspective: Support and success teams will love Product Intelligence because it validates their work and gives them a voice in product development. These teams hear customer pain every single day but often feel like their insights don't reach product and engineering. When their support tickets automatically generate feature requests that get built, it closes the feedback loop and shows that customer conversations directly impact the product.

The executive perspective: Leadership teams care about customer satisfaction, retention, and efficient resource allocation. Product Intelligence provides visibility into what's actually frustrating users versus what's just noisy but unimportant. Executives can see objective data about which product investments will have the biggest impact on customer satisfaction. This evidence-driven approach to product planning is exactly what data-oriented leaders want.

I see particularly strong acceptance potential among certain company types:

B2B SaaS companies with substantial support volumes are perfect candidates. They have enough ticket data for meaningful analysis, clear product development processes, and strong incentives to reduce churn by addressing user pain quickly.

Scale-up stage companies (50-500 employees) face the challenge of maintaining product-customer fit while growing rapidly. They're too big for founders to personally review every support ticket but not yet large enough for sophisticated product research operations. Product Intelligence fills this gap perfectly.

Product-led growth companies that rely on user experience for conversion and retention will particularly value automatic insight extraction. When your business model depends on users successfully adopting your product, understanding friction points is mission-critical.

However, I also recognize acceptance barriers:

Integration complexity: Product Intelligence needs to connect to support ticket systems, potentially product management tools, and fit into existing workflows. If implementation is complex or requires significant IT involvement, adoption will slow. The product needs to offer easy integration with popular tools like Zendesk, Intercom, Jira, and Linear.

Trust in AI analysis: Product teams might be skeptical about whether AI can truly understand nuanced user feedback. They might want to verify the AI's interpretations, which defeats the time-saving purpose. Building trust through transparency about how analysis works and allowing human oversight will be crucial.

Change management: Companies have existing processes for gathering and acting on user feedback. Introducing Product Intelligence means changing workflows, which always faces organizational resistance. Success requires not just good software but effective change management.

Cost sensitivity: Depending on pricing, smaller teams might find it hard to justify another tool subscription, especially if they're not yet drowning in support tickets. The ROI needs to be immediately obvious.

The 191 upvotes and 6 discussions on Product Hunt suggest solid but not overwhelming initial interest. This might reflect that the product is somewhat niche (appealing primarily to product managers and product-led companies) rather than broadly consumer-facing.

Overall, I believe user acceptance will be strong within the target audience of product managers at fast-growing, product-led companies with significant support volumes. These teams face exactly the problems Product Intelligence solves and have both the budget and sophistication to adopt new product tools. Wider adoption to smaller companies or non-product-led organizations will take longer and require proven case studies and clear ROI demonstrations.

Survival Rating: 3.5/5 Stars ⭐⭐⭐✨

Evaluating Product Intelligence's one-year survival prospects, I'm assigning 3.5 out of 5 stars. This reflects genuine potential tempered by significant execution challenges and competitive risks. Let me break down my reasoning.

The Opportunities

Strong Product-Market Fit: The problem Product Intelligence solves is real, painful, and universal among product teams. Every company with a product and a support function faces the challenge of extracting insights from customer feedback. The need is validated and persistent.

AI Tailwind: Launching an AI-powered product tool in 2024-2025 means riding a massive wave of AI adoption and interest. Companies are actively seeking ways to use AI for operational efficiency. Product Intelligence offers concrete, measurable value rather than speculative AI benefits.

Network Effects: As more users contribute feedback through support tickets that get analyzed, the AI's pattern recognition could improve. Companies that adopt early and consistently use the tool might see increasing value over time, creating stickiness.

Expansion Potential: While focused on support tickets initially, the underlying capability—transforming unstructured customer feedback into structured product insights—could extend to other data sources. Imagine analyzing sales call transcripts, social media mentions, community forum discussions, or NPS survey comments. The platform could become the central product intelligence hub for the entire organization.

Workflow Integration Value: Product tools that integrate into existing workflows rather than requiring separate logins and processes tend to have higher adoption and retention. If Product Intelligence can embed its insights directly into tools like Jira, Linear, or Notion, it becomes indispensable.

Clear ROI: Unlike some product tools with nebulous value propositions, Product Intelligence's benefit is quantifiable—time saved on ticket analysis, faster feature prioritization, more evidence-backed decisions. This makes it easier to justify internally and maintain budget even during cost-cutting periods.

The Risks

Competitive Threat from Adjacent Products: This is my biggest concern. Existing product management platforms (like Productboard, Aha!, or Pendo) could add similar AI-powered feedback analysis features. Customer support platforms (like Zendesk or Intercom) could build native product intelligence capabilities. If established players add this functionality, Product Intelligence faces tough competition from tools users already have.

AI Commoditization: As large language models become more accessible and powerful, the core technology behind Product Intelligence—analyzing text and extracting insights—becomes easier to replicate. The product needs defensibility beyond just "AI that reads support tickets," perhaps through proprietary data, unique integrations, or superior accuracy.

Data Quality Dependency: The product's value relies entirely on the quality and volume of support ticket data. If a company has poorly documented tickets, doesn't use a structured support system, or has low ticket volume, Product Intelligence might struggle to provide meaningful insights. This limits addressable market to more mature, product-led companies.

Proving Accuracy: Product teams will scrutinize whether the AI's feature request extraction is actually accurate and useful. If the tool frequently misinterprets feedback or suggests irrelevant features, trust erodes quickly. Maintaining high accuracy across different industries, product types, and use cases is technically challenging.

Sales Cycle Complexity: Selling to product teams in B2B contexts often requires lengthy evaluation periods, multiple stakeholder buy-in, and proof of value. Unlike consumer products with instant adoption, Product Intelligence might face 3-6 month sales cycles, slowing growth and burning runway.

Privacy and Security Concerns: Support tickets contain sensitive customer information and sometimes proprietary business details. Companies might hesitate to send this data to a third-party AI service, especially in regulated industries like healthcare or finance. Strong security credentials and potentially on-premise deployment options become necessary, increasing complexity.

Limited Switching Costs: If users aren't deeply integrated into the product, they could switch to alternatives relatively easily. Building high switching costs through deep workflow integration, historical data value, or team collaboration features is crucial but takes time.

What Needs to Happen

For Product Intelligence to not just survive but thrive over the next year, several things must happen:

-

Rapid Integration Expansion: They need to quickly integrate with all major support platforms (Zendesk, Freshdesk, Help Scout, Intercom) and product management tools (Jira, Linear, Productboard, Aha!). Seamless integration drives adoption.

-

Demonstrate Clear ROI Early: They need compelling case studies showing specific companies that used Product Intelligence to identify valuable features, prioritize correctly, and achieve measurable outcomes (reduced churn, increased adoption, faster development cycles).

-

Build Accuracy Confidence: Transparency about how the AI works, confidence scores for suggestions, and easy human override/refinement capabilities will build trust. Perhaps even some form of feedback loop where product managers can correct the AI and improve future analysis.

-

Find Product Champions: They need to identify and empower enthusiastic early adopters who become vocal advocates. Product managers love sharing tools that make their lives easier. Community building and word-of-mouth will drive growth more effectively than traditional marketing.

-

Establish Differentiation: Beyond AI-powered analysis, they need unique capabilities that competitors can't easily copy—perhaps specialized understanding of certain industries, unique visualization of product intelligence, or proprietary methodologies for prioritization.

-

Secure Adequate Funding: With only 191 upvotes on Product Hunt, they're not yet viral. They'll need runway to iterate, prove value, and achieve product-market fit before they can grow through pure market pull. Adequate funding or early revenue becomes critical.

My Honest Assessment

I'm genuinely optimistic about Product Intelligence's core value proposition. The problem is real, the solution is practical, and the timing aligns with AI adoption trends. However, I'm deducting 1.5 stars because execution risks are substantial and the competitive landscape is threatening.

The path to success requires excellent execution across multiple dimensions—product development, integration partnerships, sales and marketing, customer success, and continuous AI improvement. That's a lot of things that need to go right simultaneously.

I could see several possible outcomes over the next year:

Best case: Product Intelligence achieves strong adoption among product-led SaaS companies, demonstrates clear ROI, secures funding or achieves profitability, and either becomes a category leader or gets acquired by a larger product management platform. Probability: 30%

Middle case: They achieve modest adoption, prove value with certain customer segments, continue operating but grow slowly, and face increasing competitive pressure from larger players adding similar features. They survive but don't dominate. Probability: 40%

Challenging case: They struggle with adoption, face direct competition from established product tools adding AI features, burn through funding, and either pivot, get acqui-hired, or shut down. Probability: 30%

The 3.5-star rating reflects this realistic assessment—better than even odds of survival, but far from guaranteed success.

Final Thoughts

After analyzing Product Intelligence thoroughly, I'm impressed with the problem they're solving and the approach they're taking. Automating the extraction of product insights from support tickets is genuinely valuable work that could make product teams significantly more effective.

My main concern isn't whether the product is useful—it clearly is—but whether they can execute quickly enough and differentiate strongly enough to survive competitive threats. The next year will be critical for building integrations, proving ROI, and establishing a defensible market position before larger players notice this opportunity.

For product managers reading this, I'd say Product Intelligence is worth exploring, especially if you're at a growing B2B SaaS company drowning in support tickets and struggling to keep up with analyzing user feedback. The potential time savings and evidence-based decision making could be transformative for your product development process.

I'll be watching Product Intelligence's progress closely, hoping they can execute on their promising vision and survive the competitive challenges ahead. The product teams who figure out how to systematically extract insights from customer feedback will have a massive advantage, and Product Intelligence is pushing this capability forward.