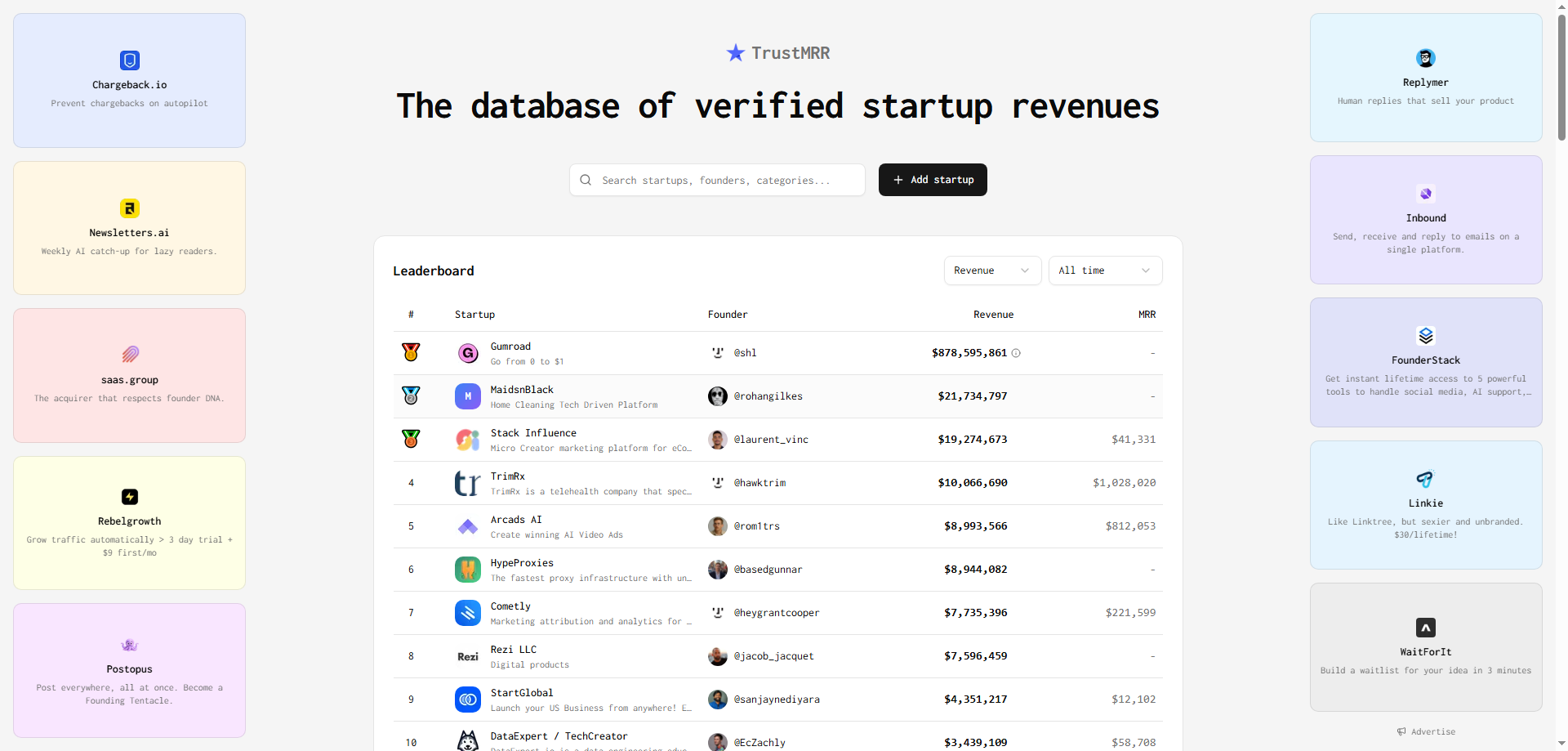

In the startup ecosystem, one of the biggest challenges is proving your growth and financial health. Whether you’re a founder looking to raise funds, an investor evaluating potential investments, or even a job seeker trying to gauge the stability of your next employer, real financial transparency has always been difficult to come by. That's where TrustMRR comes into play, offering a platform that provides verified, transparent, and real-time revenue data from startups, specifically focusing on their Monthly Recurring Revenue (MRR).

Let's explore this innovative product from four key angles: its creative approach, its potential to disrupt existing tools, how users will accept it, and a future outlook based on current risks and opportunities.

1. Creative Take: Reimagining Transparency for Startups

At the heart of TrustMRR lies a simple but powerful idea: financial transparency in the startup world. Startups often boast about their potential, their growth, and their vision, but when it comes to showing real proof, they typically lack the tools or data to back up these claims. TrustMRR flips the script by digitizing financial transparency and providing a real-time, verifiable view into the financial health of companies, particularly their MRR and other key revenue data.

The platform uses Stripe certification to ensure that the data shared by companies is accurate and can be trusted. For startup founders, this is a way to publicly prove their company’s growth and financial stability, giving them a powerful tool to gain investor confidence. For investors, it’s a way to eliminate the guesswork from decision-making. Instead of relying on self-reported numbers or pitching documents, you get real, certified financial data that tells you exactly how well a startup is performing.

The creativity here isn’t just in the product itself, but in the way it redefines how revenue data is shared in the startup ecosystem. TrustMRR allows companies to publicly showcase their earnings, which not only helps with investor relations but can also assist with attracting talent or partners. It’s about building trust and making the financial health of a company transparent to all.

2. Disruptive Potential: Can TrustMRR Replace Traditional Methods?

The idea of financial transparency in startups isn’t new, but the way TrustMRR executes it is innovative and has the potential to disrupt traditional systems of startup evaluation. Historically, investors and partners had to rely on pitch decks, self-reported figures, or rudimentary financial statements, which were often incomplete or exaggerated. TrustMRR changes the game by offering a verified database of actual revenue figures, sourced from Stripe transactions.

Let’s consider the traditional process: When an investor is looking at a startup, they typically evaluate the company’s financials, sometimes requesting proof of revenue or reviewing the company’s projections. However, this relies heavily on the honesty of the founder and the accuracy of their data. TrustMRR replaces this reliance on self-reported data with verified, real-time MRR figures, making it much easier for investors to evaluate a company’s growth trajectory and market performance.

This kind of transparency could eventually replace many traditional tools and methods used in evaluating startups. Tools like Crunchbase, PitchBook, and AngelList provide company profiles, but they don’t provide verified revenue numbers—which are crucial when assessing a startup’s financial stability and growth potential. TrustMRR’s ability to offer real-time, verified financial data means that it’s not just disrupting the way startups raise funds, but it’s also transforming how investment decisions are made.

The challenge, of course, is that financial data is just one part of the equation. No tool can replace the human element of assessing a company’s culture, leadership, and market fit. That said, TrustMRR’s ability to remove the uncertainty surrounding a startup’s revenue numbers makes it a powerful tool for investors.

3. Addressing Real-World Needs: Will Users Adopt TrustMRR?

TrustMRR addresses a real, immediate need in the startup and investment communities: verified, transparent financial data. Let’s break down how different users will benefit from this platform.

-

For Startup Founders: TrustMRR provides an unprecedented opportunity for raising capital. Instead of relying on subjective pitches or vague growth claims, founders can use Stripe-verified MRR data to prove their company’s growth. In an environment where trust is hard to come by, this gives founders a unique selling point when speaking to investors or partners. By publicly displaying their revenue data, they can attract interest from a wider pool of investors and potential collaborators who may be hesitant to invest in unproven businesses.

-

For Investors: One of the most significant challenges in startup investment is dealing with information asymmetry. Investors are often forced to rely on the projections and promises of founders, which may or may not align with reality. TrustMRR eliminates this issue by providing real-time, verified financial data. Investors can now use this data to assess a startup’s growth rate, market performance, and overall potential without relying on projections that might be inflated or inaccurate. The platform gives investors a way to filter startups based on real financial data, making it easier to find high-potential companies to invest in.

-

For Job Seekers and Talent Acquisition: For employees and job seekers, TrustMRR provides a way to evaluate the financial stability of potential employers. In a world where job security can feel uncertain, knowing a company’s revenue trajectory can give candidates more confidence in their job choices. Companies that are transparent about their financial health are also likely to be seen as more trustworthy and stable, which can attract top-tier talent.

Overall, TrustMRR serves a clear market need and will likely see adoption from users who value transparency, trust, and real data in their decision-making processes.

4. Future Outlook: Will TrustMRR Survive and Thrive in the Next Year?

Looking at TrustMRR’s potential to survive and thrive over the next year, let’s evaluate it using a 1-5 star rating system and assess some of the risks and opportunities it faces.

Rating: 4/5

Strengths:

- Verified Financial Data: TrustMRR offers a solution that solves a major pain point in the startup world—providing verified, real-time revenue data. This makes it a valuable tool for both investors and founders alike.

- Transparency for Investors and Founders: By showcasing verified revenue data, TrustMRR helps create trust in the startup ecosystem, which is essential for both fundraising and making investment decisions.

- Versatile Use Cases: Whether you’re a startup founder, an investor, or a job seeker, TrustMRR has applications for all of these groups, which broadens its market appeal.

Risks:

- Adoption by Founders: Some founders may be hesitant to disclose their financial data, especially if they are early-stage and still figuring out their revenue streams. Getting them to open up and share their figures could be a significant barrier to scaling the platform.

- Dependence on Stripe: TrustMRR’s reliance on Stripe certification for its data limits its use to companies that use Stripe as their payment processor. If TrustMRR doesn’t expand to include other payment platforms, it may miss out on a large segment of startups.

- Competition: The startup data space is competitive, with platforms like Crunchbase, PitchBook, and others offering company profiles and insights. TrustMRR will need to differentiate itself by offering something truly unique, namely the real-time verified revenue data, which is not yet commonplace.

Opportunities:

- Expansion Beyond Stripe: If TrustMRR can integrate with other payment platforms like PayPal, Braintree, or Square, it could expand its reach and include a wider range of startups.

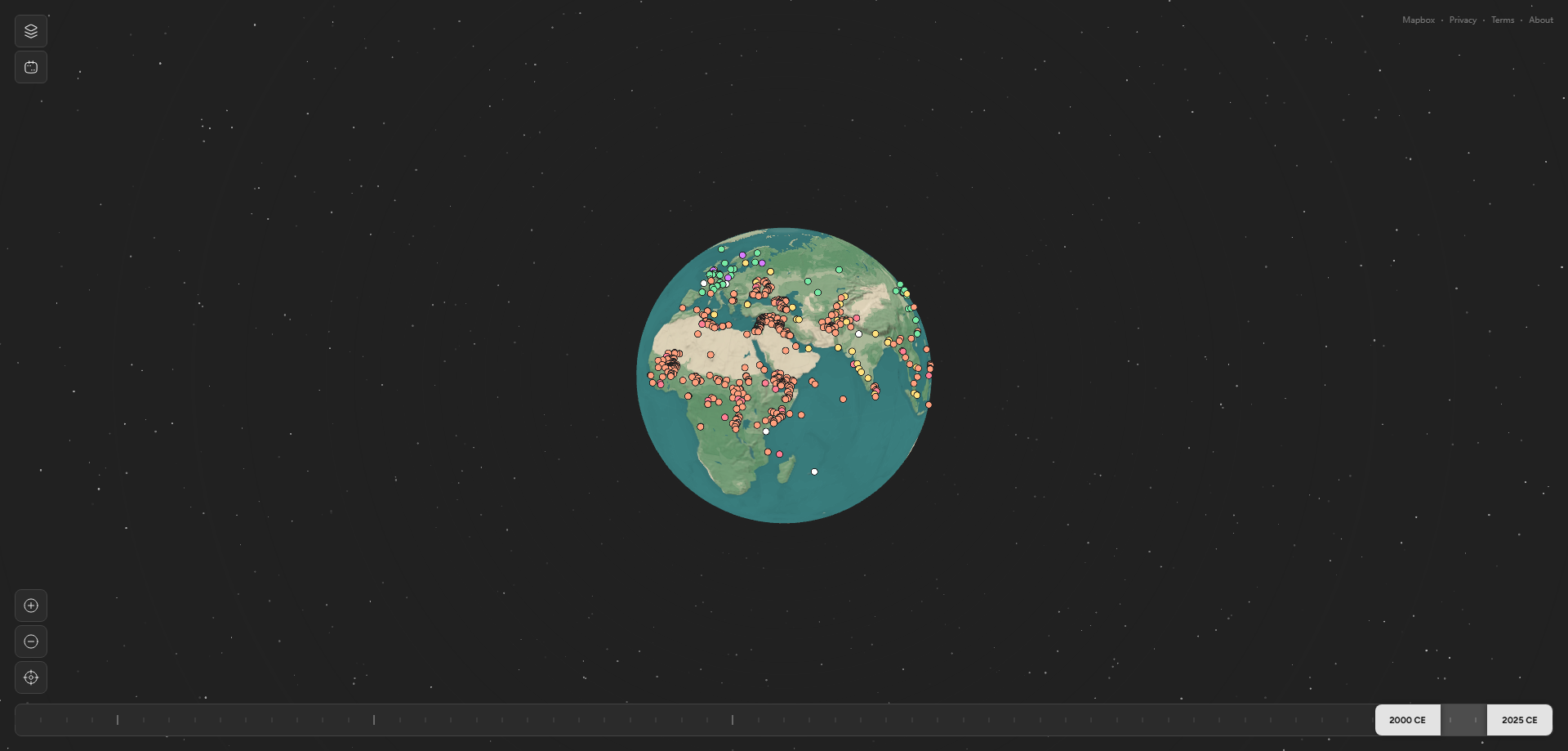

- Global Market Expansion: The platform currently focuses on US-based companies, but as the global startup ecosystem grows, there is ample opportunity to expand TrustMRR’s data offering to international markets.

- Data Analytics and Insights: TrustMRR could build on its core offering by adding more data analytics and growth tracking features to attract more sophisticated users like VCs and market analysts.

Conclusion

TrustMRR has a lot of potential to shake up the startup world by providing verified, transparent, and actionable financial data. It addresses a critical need for real-time revenue transparency, which can benefit founders, investors, and job seekers alike. While it faces challenges in terms of adoption and competition, TrustMRR’s innovative approach to financial transparency and its focus on verified revenue data make it a product worth watching in the next year. If it continues to evolve and grow its user base, it’s poised to become a key player in the startup and investment ecosystem.