The Creative Intelligence Behind Automated Financial Wisdom

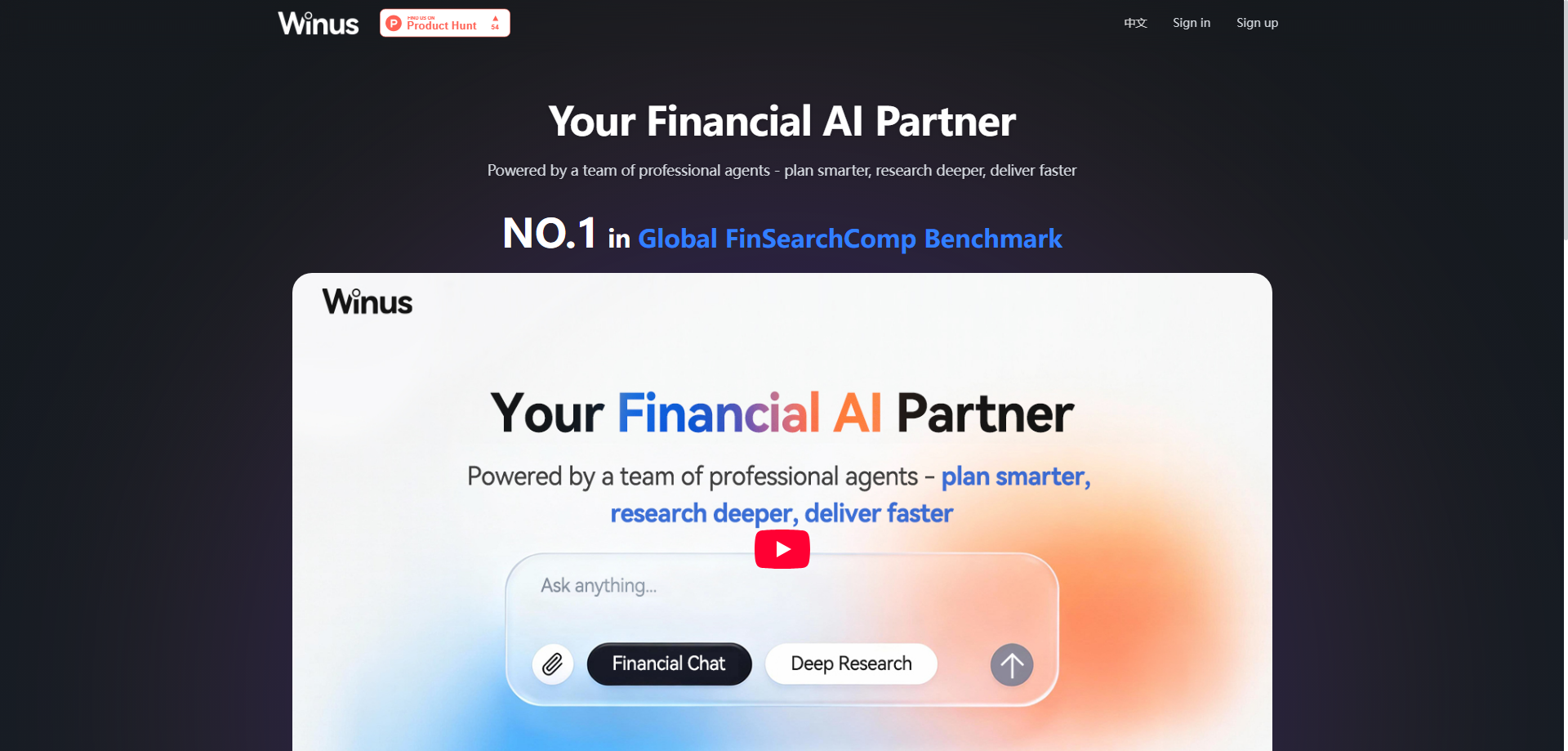

When I first encountered Winus, I was immediately struck by the ambition of their positioning: "Your intelligent financial partner." In an industry historically dominated by human advisors charging substantial fees, the idea of an AI financial assistant that promises wisdom, precision, and trust is genuinely bold. Let me explain why this creative approach matters.

The creative insight behind Winus lies in recognizing that financial decision-making has always suffered from an access problem. High-quality financial advice, comprehensive market research, and personalized investment planning have traditionally been available only to wealthy individuals who can afford private wealth managers or institutional investors with dedicated research teams. Everyone else gets cookie-cutter robo-advisors or overwhelming amounts of information they don't know how to interpret.

Winus attempts to bridge this gap by positioning itself as a professional-grade AI financial assistant accessible to anyone. The "powered by professional agents" messaging suggests they're not just using generic AI models but have built specialized agents trained specifically for financial analysis, investment planning, and research. This specialization is where the creative value emerges.

What I find particularly clever is the emphasis on traceability. Financial decisions carry real consequences—people's retirement savings, children's education funds, life goals. The anxiety around "trusting an AI with my money" is legitimate. By promising full data traceability and proven benchmark performance, Winus addresses this trust barrier creatively. You're not just getting AI recommendations; you're getting transparent explanations of where the data comes from and how the analysis compares to established benchmarks.

The global data coverage at affordable pricing represents another creative positioning choice. Traditional financial research platforms like Bloomberg Terminal or FactSet cost thousands of dollars monthly. By making global financial data accessible through an AI interface at presumably lower cost, Winus democratizes access to institutional-grade information. This "institutional capabilities at retail prices" approach could genuinely disrupt how individual investors and small financial firms access market intelligence.

I'm impressed by the dual audience approach—serving both individual investors seeking smart financial planning and financial professionals needing research tools. Many fintech products choose one lane. Winus's creativity lies in recognizing that both audiences need similar underlying capabilities (data analysis, research, reporting) but packaged differently. An individual wants "tell me what to invest in," while a financial advisor wants "give me data to support my client recommendations." The same AI agent infrastructure can serve both with different interfaces.

The automated report generation capability addresses a genuine creative friction in financial work. I've seen financial professionals spend hours collecting data, creating charts, and formatting reports. If Winus can transform raw financial data into polished, comprehensible reports automatically, that's not just saving time—it's removing a barrier that prevents many financial insights from being shared because the effort to communicate them is too high.

From a user experience creativity perspective, Winus seems designed to reduce cognitive load in financial decision-making. Finance is intimidating for most people—the jargon, the complexity, the fear of making expensive mistakes. An AI financial assistant that can translate "I want to save for my kid's education" into a concrete, data-backed investment plan removes layers of complexity that typically prevent people from taking action.

The risk assessment and portfolio optimization features suggest Winus isn't just about providing information—it's about actively improving your financial position. This proactive intelligence, where the AI identifies gaps in your portfolio or opportunities you've missed, represents a shift from passive tool to active financial partner.

Can Winus Disrupt Traditional Financial Services?

Examining whether this AI financial assistant can replace existing financial products and services, I see both significant opportunities and substantial limitations. The financial services industry is ripe for disruption but also heavily entrenched and regulated.

Versus Human Financial Advisors: Traditional financial advisors charge 1-2% of assets under management annually. For someone with a $500,000 portfolio, that's $5,000-$10,000 per year. If Winus can provide comparable investment planning, portfolio optimization, and ongoing advice for a fraction of this cost, the economic case for disruption is compelling.

However, human advisors provide things AI currently struggles with—emotional support during market volatility, holistic life planning that integrates non-financial factors, and the human relationship that builds trust over decades. Winus might handle the analytical and data-driven aspects of financial advice better than humans, but the emotional and relational components remain human territory.

I think the realistic disruption scenario is Winus replacing entry-level and mid-tier financial advisors for younger, tech-comfortable investors with straightforward financial situations. Complex estate planning, tax optimization across multiple jurisdictions, or managing significant wealth still likely requires human expertise.

Versus Robo-Advisors: Platforms like Betterment, Wealthfront, and Vanguard's digital advisor already offer algorithm-driven investment management at low cost. How does Winus differentiate? The key seems to be depth of research capabilities and customization. Basic robo-advisors use simple algorithms based on age and risk tolerance. Winus's AI agent approach suggests more sophisticated analysis considering market trends, economic indicators, and personalized factors.

If Winus truly delivers deeper intelligence while remaining affordable, it could capture market share from existing robo-advisors. However, established robo-advisors have significant advantages—regulatory approvals, integrated brokerage accounts, and years of proven track records. Winus needs to demonstrate substantially better results to justify switching costs.

Versus Financial Research Platforms: For professional users, Winus competes with Bloomberg Terminal, FactSet, Refinitiv Eikon, and similar tools. These platforms dominate institutional finance but cost $20,000+ annually. If Winus offers even 60-70% of their capabilities at 10% of the cost, that's disruptive for smaller financial firms, independent analysts, and serious individual investors.

The challenge is credibility. Financial professionals trust Bloomberg because it's been the industry standard for decades. Every analyst, trader, and portfolio manager uses it. Winus needs to prove that its data quality, update frequency, and analytical depth match professional standards. One data error that costs a client money could destroy credibility.

Versus Manual Research and Excel: Many individual investors and small financial firms still do research manually—reading earnings reports, building spreadsheets, tracking metrics individually. This is time-consuming and error-prone. Winus's automation of data collection, analysis, and report generation could genuinely replace hours of manual work.

For this segment, the disruption potential is strong because the alternative isn't another sophisticated tool—it's tedious manual work. Any AI financial assistant that reliably automates this process creates immediate value.

Where Winus Likely Won't Disrupt: Complex financial products like derivatives, structured notes, or alternative investments require specialized expertise that general AI assistants probably can't match. Regulatory compliance, tax planning, and legal aspects of finance remain areas where human expertise is essential. High-net-worth individuals with complex financial situations will likely continue using human advisors, perhaps supplemented by AI tools.

The Regulatory Challenge: This is the biggest wild card for disruption. Financial advice is heavily regulated in most jurisdictions. Depending on how Winus is structured, they might need to register as an investment advisor, comply with fiduciary standards, or meet specific disclosure requirements. Navigating these regulations while maintaining the "accessible AI" positioning is extremely challenging.

Overall, I believe Winus has genuine potential to disrupt financial planning for mass-market investors and provide valuable research automation for financial professionals. But completely replacing human advisors or institutional-grade platforms requires overcoming significant trust, regulatory, and performance hurdles.

User Acceptance: Trust, Transparency, and Financial Anxiety

From a practical needs perspective, assessing user acceptance for an AI financial assistant involves understanding not just whether it's useful, but whether people will trust it with their money. This is where things get psychologically complex.

The "DIY Investor" Segment: Individual investors who currently manage their own portfolios using basic tools or robo-advisors represent a prime audience for Winus. These users are comfortable with technology, want to optimize their investments, but lack sophisticated research capabilities. If Winus can provide institutional-quality insights at retail prices, this segment should embrace it enthusiastically.

I personally fall into this category—I manage my own investments but constantly wish I had better research tools and analytical capabilities. An AI financial assistant that could identify portfolio gaps, suggest optimization opportunities, and provide data-backed recommendations would be immediately valuable.

The "Financial Professional" Segment: Advisors, analysts, and consultants at smaller firms who can't afford Bloomberg but need credible research tools represent another strong use case. The automated report generation alone could save hours weekly. The 89 discussions on Product Hunt (relative to 54 upvotes) suggest professionals are actively engaging with the concept, which is a positive signal.

However, acceptance here requires proving data quality and analytical accuracy. Financial professionals stake their reputation on the advice they give. They'll rigorously test Winus before trusting it with client-facing work. Early mistakes could kill adoption in this segment.

The "Financial Novice" Segment: People with limited financial knowledge who want to start investing but feel overwhelmed represent the largest potential market. This segment desperately needs guidance but often can't afford or doesn't want to pay for human advisors.

Here's where I have concerns about acceptance. Financial novices might not understand how to evaluate whether Winus's recommendations are good. They want simple answers—"tell me where to put my money"—but good financial advice requires understanding goals, risk tolerance, time horizon, and personal circumstances. Can Winus gather this information effectively through an AI interface? Will users provide accurate information?

Additionally, when markets inevitably decline and portfolios lose value, will novice users blame Winus? The emotional aspect of watching your savings decrease is powerful. Human advisors manage this through relationship and communication. Can an AI provide adequate emotional support during volatility?

The Trust Barrier: This is the fundamental acceptance challenge. People are deeply emotional about money—it represents security, dreams, survival. Trusting an AI with financial decisions requires enormous confidence in the technology. The traceability and benchmark performance features help, but one high-profile failure (an AI recommending an investment that collapses) could devastate adoption.

Financial mistakes are also more consequential than other AI errors. If ChatGPT gives me a wrong answer about history, no harm done. If an AI financial assistant leads me to lose my retirement savings, that's life-altering. This asymmetry in consequences makes users rightfully cautious.

Regulatory and Liability Concerns: Users will ask: "If I follow Winus's advice and lose money, who's responsible?" Financial advisors carry liability insurance and fiduciary obligations. What protections exist with AI recommendations? This legal ambiguity could make risk-averse users hesitant.

Acceptance Drivers: Several factors could accelerate adoption:

- Performance demonstrations: Clear track records showing Winus's recommendations outperforming benchmarks would build confidence rapidly.

- Educational content: Helping users understand what Winus does and how to use it effectively reduces intimidation and increases comfort.

- Gradual adoption path: Letting users start with small amounts or paper trading before committing real money builds trust incrementally.

- Transparency: Showing exactly how recommendations are generated and allowing users to understand the reasoning creates confidence.

Acceptance Barriers: Several factors could limit adoption:

- Complexity overload: If Winus presents too much data or analysis, novice users might feel overwhelmed rather than empowered.

- Cost concerns: If pricing isn't genuinely affordable, the value proposition collapses. Users can get free robo-advisors or pay a lot for human advisors.

- Skepticism of AI: Many people remain fundamentally skeptical about AI making financial decisions, regardless of capability.

Overall, I believe acceptance will be strongest among tech-savvy individual investors and financial professionals seeking research automation. Mainstream adoption to financial novices requires exceptional onboarding, education, and proven results that overcome deep-seated anxiety about AI handling money.

Survival Rating: 2.5/5 Stars ⭐⭐✨

Evaluating Winus's one-year survival prospects, I'm giving it 2.5 out of 5 stars. This relatively pessimistic rating reflects the enormous challenges of building a financial services product, even with solid technology. Let me explain thoroughly.

The Opportunities

Massive Market Size: The global wealth management and financial advisory market is worth trillions. Even capturing a tiny fraction represents substantial revenue opportunity. The addressable market is genuinely enormous.

Clear Pain Points: High fees from human advisors, limited access to quality research for retail investors, and time-consuming manual analysis for professionals are all real, validated problems. Winus addresses genuine needs.

AI Capability Advancement: Large language models and AI agents have reached a sophistication level where complex financial analysis is feasible. The technology foundation exists to deliver on Winus's promises.

Democratization Trend: Financial services are gradually becoming more accessible and affordable. Winus rides this trend toward democratizing sophisticated financial tools.

Professional Market Opportunity: Smaller financial firms needing research capabilities but unable to afford institutional platforms represent a concrete, underserved niche.

The Risks

Regulatory Nightmare: This is my primary concern. Financial advice is heavily regulated globally. Depending on jurisdiction and how Winus operates, they might need investment advisor registration, comply with fiduciary standards, meet disclosure requirements, and navigate complex regulations. One regulatory violation could shut down the business or result in crippling fines.

Many fintech startups have struggled or failed due to regulatory challenges they didn't adequately anticipate. Without seeing explicit information about Winus's regulatory strategy, I'm concerned they might underestimate this complexity.

Liability Exposure: If users lose money following Winus's recommendations, what's the company's liability? Financial advice carries legal responsibility. Even with disclaimers, lawsuits from unhappy users could drain resources and create negative publicity. Managing this risk requires expensive insurance and legal infrastructure.

AI Reliability Questions: Financial markets are complex, unpredictable, and occasionally irrational. Can AI agents consistently provide good advice across varying market conditions? What happens during black swan events or unprecedented situations? One major failure where Winus gives catastrophically bad advice could destroy the company.

Intense Competition: The space is crowded. Established robo-advisors have millions of users and years of operation. Major financial institutions are building AI capabilities internally. Fintech startups with massive funding are attacking similar problems. Standing out and acquiring users is brutally difficult.

Trust Building Challenge: As discussed, getting people to trust AI with money is hard. Building credibility from zero requires time, track record, and flawless execution. Many promising financial apps have failed simply because they couldn't overcome the trust barrier fast enough.

Monetization Difficulty: Financial services pricing is tricky. Charge too much, and users stick with established alternatives or free tools. Charge too little, and you can't cover the substantial costs of data, AI infrastructure, regulatory compliance, and customer support. Finding sustainable unit economics is challenging.

Data Quality Dependency: Winus's value depends entirely on data quality and analytical accuracy. Bad data leads to bad recommendations, which destroys trust instantly. Maintaining data quality across global markets is expensive and operationally complex.

Limited Product Hunt Traction: Only 54 upvotes suggests limited initial enthusiasm. While 89 discussions show engagement, the low vote count indicates Winus hasn't captured widespread excitement. This could signal product-market fit challenges.

What Needs to Happen

For Winus to survive and succeed:

-

Establish regulatory compliance immediately: This isn't optional. They need proper registrations, legal structure, and compliance infrastructure before scaling.

-

Build demonstrable track record: They need documented cases showing Winus's recommendations produced good outcomes. Without performance proof, trust remains theoretical.

-

Secure adequate funding: Building a financial services platform requires substantial capital for technology, data, compliance, and marketing. Undercapitalization is fatal.

-

Focus on specific niche initially: Rather than trying to serve everyone, dominating one segment (e.g., financial professionals at small firms) could establish credibility before expanding.

-

Develop risk management systems: They need robust safeguards preventing catastrophically bad recommendations and clear communication about limitations and risks.

-

Create educational content: Users need to understand what Winus does, how to use it effectively, and what to expect. Education drives adoption and appropriate usage.

My Honest Assessment

I'm giving 2.5 out of 5 stars because building a successful financial services product is exceptionally difficult, even with good technology. The regulatory complexity, liability risks, trust barriers, and intense competition create a gauntlet that most startups don't survive.

The most likely scenarios:

Struggle scenario (40% probability): Winus launches but struggles to gain significant user traction. Regulatory challenges slow development, customer acquisition is expensive, and the product remains a niche tool with limited adoption. They limp along without achieving sustainability.

Regulatory/legal challenges (25% probability): They encounter regulatory obstacles they can't overcome, or face legal action from users or regulators. The company pivots, restructures, or shuts down.

Acqui-hire scenario (20% probability): A larger financial institution or fintech company acquires Winus for the technology and team rather than continuing as independent product.

Niche success (10% probability): They find a specific segment (perhaps financial professionals) where they deliver clear value, achieve modest profitability, and survive as a focused but limited product.

Breakout success (5% probability): Everything goes right—they navigate regulations, build trust, acquire users rapidly, and become a significant player in AI-powered financial services. Possible but unlikely given the challenges.

The 2.5-star rating reflects realistic assessment of the immense challenges facing financial services startups, regardless of technology quality.

Final Thoughts

After thoroughly analyzing Winus, I appreciate the ambition of democratizing sophisticated financial intelligence through AI. The vision of making institutional-grade research and personalized investment planning accessible to everyone is genuinely worthwhile.

For the right user—a tech-savvy investor wanting better research tools, or a financial professional at a small firm needing analytical capabilities—Winus could provide real value if execution is solid.

However, I remain deeply concerned about the viability of this business. Financial services is one of the most challenging industries for startups due to regulatory complexity, trust requirements, and entrenched competition. Many well-funded, talented teams have tried to disrupt finance with technology and failed.

If you're considering using Winus, I'd recommend extreme caution. Start with small amounts, verify recommendations independently, and don't trust any AI with money you can't afford to lose. The technology might be impressive, but financial consequences are real.

I'll be watching Winus's progress, hoping they can navigate the obstacles successfully. The world needs better, more accessible financial tools. But wanting something to succeed doesn't change the difficult reality of making it happen.